Top National Parks in Japan

READ THIS ARTICLE

26 Feb 2026

Coverage for life-threatening PED conditions##

Student travel insurance is an insurance plan for students pursuing higher studies in a foreign country. This type of travel abroad insurance typically offers financial coverage for medical, non-medical and trip-related emergencies to individuals going abroad on a student visa. Apart from your details, you will be asked for your course details, the university admission details, and course tenure when you apply for student travel insurance.

While securing your study trip may seem tiring, here is why you must not skip student travel insurance when planning a study term abroad.

Even after meticulous planning, international travel may sometimes bring unforeseen surprises. Therefore, to simplify your journey, we offer “Student Explore—travel insurance for students.” Here, check out some of our best International Travel Insurance plans to secure your international trip.

Reports suggest that India has seen an increase of around 52% in students leaving their home country to pursue higher education in a foreign country. This number increased from 5,86,337 in 2019 to 8,92,989 in 2023. People consider foreign countries to land an enlightening career and a bright future.

While a financial backup, a scholarship, and side hustles such as part-time jobs may help you have a comfortable term abroad, an unforeseen emergency might require you to have student trip insurance. Below are a few reasons why overseas student travel insurance is a must.

Cost of Living can be expensive

Given the high cost of living, even healthcare abroad can be expensive as compared to that in India. Therefore, you may need health insurance for students studying abroad to cover your term against medical emergencies.

University insurance may not be enough

University-led overseas student insurance may only cover emergencies within the university, overlooking other unforeseen circumstances. Hence, student travel insurance from your home country becomes a must.

Offers peace to parents

International student insurance from a renowned insurer in your home country offers comprehensive coverage and peace of mind to your loved ones back home.

Protects you amidst trip interruptions

Unplanned trip interruptions may cost you a loss of tuition fee. While you cannot prevent an emergency, having overseas student insurance shall share your burden of incurred expenses.

Easily accessible

Student travel insurance from your home country shall be readily accessible not just to you but also to your parents back home, ensuring easy access to services such as claim settlement, trip extension, etc.

At Care Health Insurance, we keep in mind the unique needs that students may have from their travel insurance plan. Thus, we design student travel insurance with the following coverage:

*Please read the policy T&Cs, brochure, and prospectus to learn more about our health insurance for study coverage, as coverage may vary.

Travel insurance for students from Care Health Insurance comes with certain limitations. Hereby mentioned are a few conditions we do not cover under our student travel insurance:

#You can avail of the above exclusions by adding optional covers and paying a slightly higher premium.

International health coverage for students offers medical, non-medical, and trip-related coverage for individuals pursuing higher studies abroad. Below is a step-by-step guide on how the plan works.

The eligibility criteria for the Student Travel Insurance from Care Health Insurance are as follows:

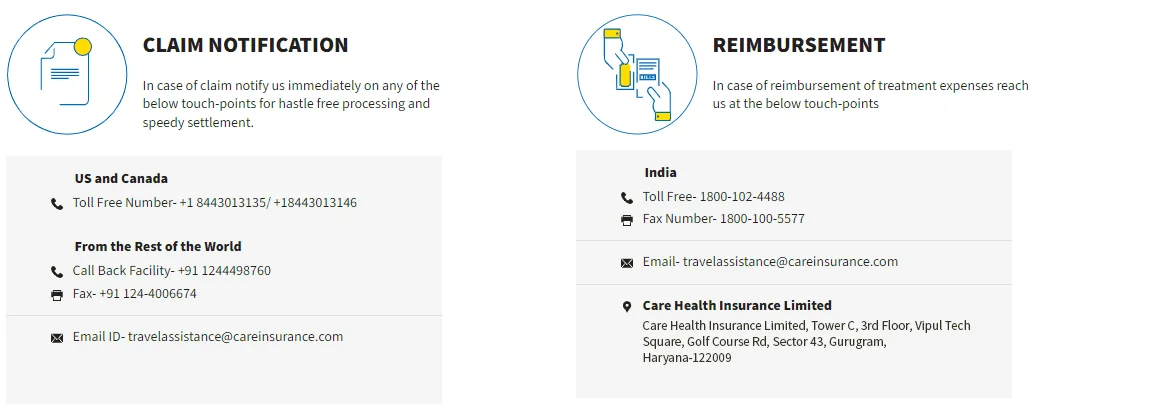

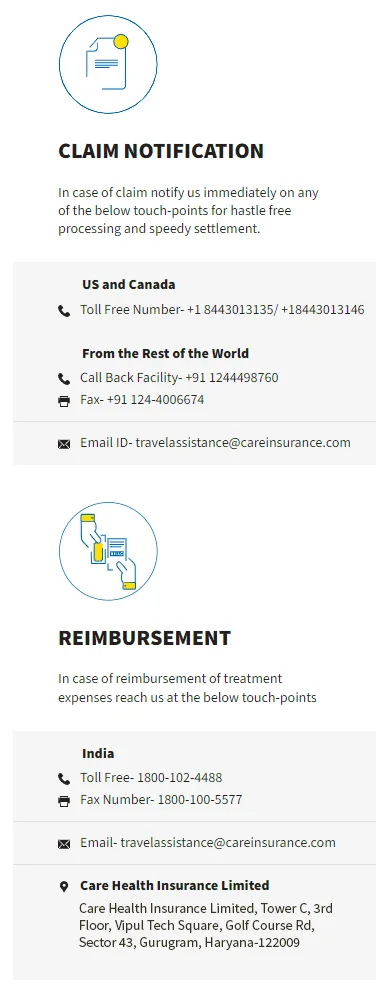

To file a claim under Care Health Insurance’s Student Travel Insurance, you will have to inform your insurance agent regarding the claim. If a situation of non-intimation occurs, then the insurer from Care Health Insurance may invalidate the claim. The service provider details for various countries include:

Choosing student travel insurance online from Care Health Insurance allows you to assess the plan’s coverage and make an informed decision. By following the below-mentioned steps, you can ensure a successful purchase of student travel insurance:

Step 1

Visit the official website of Care Health Insurance and navigate to the dropdown of student travel insurance.

Step 2

On the right side of the page, you will find an online premium calculator. Enter your mobile number on the calculator and click the “calculate premium” option.

Step 3

On the next pages, provide information such as your destination country and your study tenure to proceed.

Step 4

Complete the proposer’s details, insured details, additional information, and the insured's medical history and pay to complete your purchase.

Student travel insurance covers the significant aspects of your international study trip, including medical expenses, trip-related hiccups, university insolvency, etc. Here are some benefits that you get when you are covered under the Student medical insurance plan from Care Health Insurance:

Thanks to the online admission procedure and the available scholarship programmes, pursuing higher education in a foreign land has become easier than ever before! But did you know that certain countries require medical insurance for students studying abroad?

Read on to get the list of the destinations.

The US is undoubtedly among the best countries for students to aspire to pursue higher education. However, the destination is also well-known for its expensive cost of living. Therefore, the top universities in the country have mandated travel health coverage for Indian students.

Harvard University, Princeton University, and Stanford University are a few options where you can land and build your dream career.

The UK is another country that offers dream careers to students from across the globe. However, due to the expensive medical infrastructure and the possibility of financial liability, universities in the UK have mandated travel health insurance for students abroad.

If pursuing a career in the UK is your dream, you can aim for universities such as Oxford, Cambridge, University of London, etc.

In 2024, until August, 1,37,445 Indian students got a Canadian student visa. This accounts for a large Indian population to pursue their dream career in Canada. Therefore, Canadian universities offer overseas student insurance and admission forms to ensure a convenient and hassle-free career.

The University of Toronto, the University of British Columbia, and McGill University are the top universities to which one can aspire for an enlightening career.

Germany is yet another country well-known for its excellent educational infrastructure. The country offers excellent scope for a bright career in universities such as Ludwig Maximilians University (LMU), Munich, University of Cologne, Goethe University, Frankfurt, Technische Universität, and Berlin. However, being in the Schengen region, one must have mandatory student travel insurance while applying for a student visa.

Ensuring your study trip is possible even with budget constraints. All you have to do is select an insurer online, evaluate the coverage, and compare multiple plan options before finalising the best health insurance for students studying abroad. Mentioned below are a few tips that you must keep in mind.

Purchase the plan online: International student travel insurance allows you to finalise a plan by comparing multiple online options. Various insurers also offer exclusive online discounts, contributing to lower travel insurance premiums.

Analyse the risks: Plan ahead of your trip and look for any risks. If you want adventure activities, look for a plan that offers optimum coverage. However, if adventure activities are not part of your plan this time, choose a plan that excludes the coverage for adventure activities. This way, you will be able to eliminate the premium charged.

Consider your university requirements: Certain universities offer health coverage for international students as a pre-included feature. While student travel insurance can still ensure optimum coverage, selecting a plan that complements the university-offered coverage at an affordable premium is wise.

Opt for deductibles: Choosing the right deductible for your student travel insurance ensures that you share the expenses with your insurer. Therefore, the premium charged might also be less.

If you travel abroad for an exchange programme under a student visa, you can also secure your international trip with a comprehensive student travel insurance plan. The documents required to purchase the student travel insurance for an exchange program shall include the international university you are visiting, your tenure of stay, course details, etc.

The overseas student travel insurance from Care Health Insurance allows you to secure your educational venture through an all-encompassing insurance policy. Having a plan that can aid you in times of medical and non-medical travel-related emergencies makes it easier for you to study abroad. However, to buy the best health insurance for students studying abroad, you must compare student travel insurance from various insurance providers and read the policy documents carefully.

Note: The per-day premium has been calculated for an individual aged 24 for a 90-day trip, with starting coverage available in that region.

With Student Explore, kickstart a worry-free term abroad!

Sales:1800-102-4499

Services: 8860402452

Live Chat

Student Explore: UIN - IRDA/NL-HLT/RHI/P-T/V.I/71/2014-15

Disclaimer: The information provided is for reference purposes only. Please refer to the official websites for country-specific information and policy documents for details on plan benefits, coverage, and exclusions.

^^Number of Travellers Served till Dec'25

**Number of Claim Amount Paid as of Dec'25

^Family members on the same policy with the same sum insured receive discounts on the premium of additional members covered: 2 members 5%, 3 members 10%, 4 members 15%, 5 members 17.5%, 6 members 20%.

##The life-threatening pre-existing diseases are covered up to 10% of the sum insured (max. up to $10,000) if disclosed during policy purchase.

~The premium is calculated for a traveller who opts for a sum insured of $30,000 for 30 days, with no pre-existing disease.