Save tax up to ₹75,000~ u/s 80D

Heart insurance is a type of health insurance that covers the treatment expenses of heart-related ailments, illnesses or hospitalisations for individuals with cardiac conditions which are corrected now.

Care Health Insurance offers coverage for patients who have been diagnosed with a cardiac ailment or have previously undergone heart surgery in the last 7 years and recovered. The plan focuses on managing costs associated with both treatment and recovery.

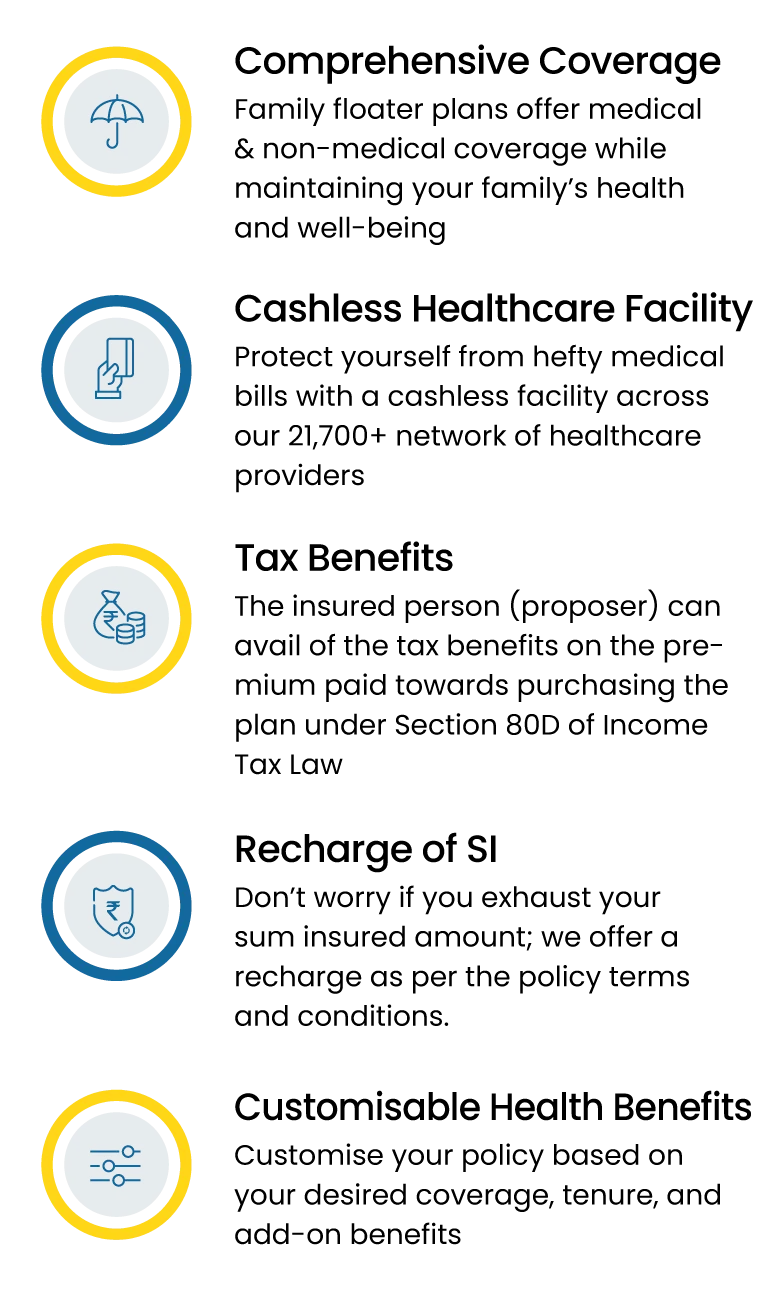

Heart ailments may cause health discomfort and even pinch your pocket! Thus, Care Heart is designed to meet the criteria for the best medical insurance for heart patients. Here are some incredible advantages that make this plan essential for heart patients:

Heart insurance is designed for individuals with a pre-existing heart-diseases i.e. someone who has undergone a heart surgery in the last 7 years.

While family health insurance plans are adequate to protect your loved ones' health and finances, it's wise to consider specialised pre-existing heart disease insurance if you or someone you care about has a heart condition.

Remember only treatments not specified under the permanent exclusions of the policy are covered:

Affordable health insurance for heart patients provides comprehensive coverage to support your medical needs. These plans often include features such as:

| Features | Coverage Details |

|---|---|

| SI Options | Rs 3,5,7&10L |

| In-Patient Hospitalisation | Up to SI |

| Daycare Treatments | Up to SI |

| ICU Charges | Up to 2% of SI per day in 3L SI No Limit for 5L/7L/10L |

| Pre-Hospitalisation Cover | 30 days; Maximum up to 5% of SI |

| Post-Hospitalisation Cover | 60 days; Maximum up to 5% of SI |

| Alternative Treatments | Up to SI |

| Domiciliary Hospitalisation | Up to SI |

| Ambulance Cover | Up to Rs 2000 in SI Rs 3&5L Up to Rs 3000 in SI Rs 7&10L |

| Cardiac Health Check-up | Annually |

| Automatic Recharge | Up to SI |

| No Claim Bonus | Up to 50% |

Our best health insurance for heart patients provides financial protection to those undergoing pre-existing heart illness. Below are the coverage benefits of our heart insurance

Mediclaim policy for a heart patient covers major medical treatment expenses. However, some expenses are not covered, as listed under exclusions. They include costs related to:

Add-ons are the extended coverage that you can purchase for your existing heart insurance policy by paying an extra premium. Here is the list of various add-ons that you can buy with care health insurance for heart health :

Care OPD - With the add-on of Care OPD under the mediclaim policy for a heart patient, each insured member can avail of up to 8 OPD consultations (4 with General Physicians, 4 with Specialised doctors) as per policy terms.

Care Shield - This benefit can be divided into three features:

Home Care - This add-on covers expenses for hiring a qualified nurse as recommended by a medical practitioner. The home care benefit provides care and convenience for necessary daily activities. No payment is made for the first 24 hours (deductible of 1 day).

If treatment involving advanced technologies is administered during hospital admission, whether as inpatient or day care treatment, such treatments are covered.

Heart health insurance provides coverage for heart conditions, covering treatments, surgeries, hospitalisation expenses, medications, and consultations. Know how heart health insurance works:

Heart treatment often involves specialised care, repeat hospital visits, and long-term management. Choosing the right health insurance helps ensure treatment decisions are driven by medical needs, not cost concerns. Remember that coverage is subject to the terms and conditions of the policy and excludes treatments listed under permanent exclusions.

After selecting the appropriate medical insurance for heart patients for yourself or a family member, you can buy the policy online by following these steps:

Once approved, you'll receive the health insurance documents for heart patients via your registered email, including the e-health card.

Care Heart health insurance for heart patients is tailored to meet the needs of individuals of different ages. Below are the eligibility details:

To make the process of purchasing a Care Heart insurance policy smooth and hassle-free, you need to provide the following documents:

*Other necessary documents for health insurance for heart patients, as requested by the insurer.

Filing a medical insurance claim for heart patients is similar to submitting a claim for a regular health plan. At Care Health Insurance, you can effortlessly start a cashless or reimbursement claim by following these easy steps.

Please notify our claims team within 24 hours if there is an emergency hospitalisation, and at least 48 hours before any planned hospitalisation.

| Cashless Claim Process | Reimbursement Claim Process |

|---|---|

|

Step 1: Please notify our team about your claim, or download the Care Health Insurance App. Step 2: Go to any network hospital and complete the pre-authorisation process. Step 3: Once approved, proceed to complete the necessary medical treatment. Step 4: Our claims team will examine your records and bills and will process the payments to the hospital. |

Step 1: Submit your claim form and other required documents. Step 2: The policyholder gets approval after receiving a verification letter. Step 3: Respond to the questions raised by the claim management team. Step 4: Once approved, the insurance company will process the payments. If the claim is rejected, the claims team will explain the reasons to you. |

Choosing the right health insurance is crucial, especially for individuals with heart conditions. Here’s why opting for Care Health Insurance is a wise and dependable choice for you and your family:

Heart health insurance provides coverage for heart conditions, covering treatments, surgeries, hospitalisation expenses, medications, and consultations. Know how heart health insurance works:

Selecting the appropriate health insurance for heart patients is crucial, given that cardiac treatments can be costly and require lifelong management. An effective plan should cover major surgeries and provide continuous care, offering financial security and peace of mind. Consider these key factors when choosing the best health insurance for a heart patient in India:

Care Heart health insurance for heart patients is tailored to meet the needs of individuals of different ages. Below are the eligibility details:

To make the process of purchasing a Care Heart insurance policy smooth and hassle-free, you need to provide the following documents:

*Other necessary documents for health insurance for heart patients, as requested by the insurer.

Filing a medical insurance claim for heart patients is similar to submitting a claim for a regular health plan. At Care Health Insurance, you can effortlessly start a cashless or reimbursement claim by following these easy steps.

Please notify our claims team within 24 hours if there is an emergency hospitalisation, and at least 48 hours before any planned hospitalisation.

| Cashless Claim Process | Reimbursement Claim Process |

|---|---|

|

Step 1: Please notify our team about your claim, or download the Care Health Insurance App. Step 2: Go to any network hospital and complete the pre-authorisation process. Step 3: Once approved, proceed to complete the necessary medical treatment. Step 4: Our claims team will examine your records and bills and will process the payments to the hospital. |

Step 1: Submit your claim form and other required documents. Step 2: The policyholder gets approval after receiving a verification letter. Step 3: Respond to the questions raised by the claim management team. Step 4: Once approved, the insurance company will process the payments. If the claim is rejected, the claims team will explain the reasons to you. |

Look for hospitals around you

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services:

8860402452

Live Chat

Care Heart: UIN - RHIHLIP21371V022021

Disclaimer: The information above is just for reference. Kindly read the T & C of the policy thoroughly. Do refer to IRDAI guidelines for tax exemption conditions.

~Tax benefit is subject to changes in tax laws. Standard T&C Apply

~~Claim Settlement Ratio for the period April 2025 to Dec 2025

**Number of Claims Settled as of Dec 2025

^^Number of Cashless Healthcare Providers as of Dec 2025

*Premium calculated for an individual (Age 18) for sum insured 3 lakhs, 10% discount is applicable for a 3-year policy

^The premium is calculated for an insured individual (18) who opts for a sum insured of 3 lakh in a zone 3 city.