Save tax up to ₹75,000~ u/s 80D

Health insurance for diabetes is a specialised plan that offers coverage for people diagnosed with diabetes. It typically includes clinical costs such as doctor consultations, diagnostic tests, and medications. The policy helps address the unique healthcare needs of people with diabetes, providing coverage for routine check-ups, insulin, and related treatments.

According to a Lancet Study, India has more than 100 million diabetics. An inactive lifestyle, unhealthy eating habits, work pressure, and stress give rise to diabetes, hypertension & obesity. With the best health insurance for diabetics in India, people can ensure quality treatment during a medical emergency without draining their savings.

Cover Highlights

The key reasons to buy a medical insurance policy for diabetes include:

At Care Health Insurance, we offer diabetes coverage under Care Freedom plan to meet the medical needs of a diabetic patient. This plan not only includes routine treatments but may also offer additional benefits, such as annual health screening, wellness programs or nutritional consultations.

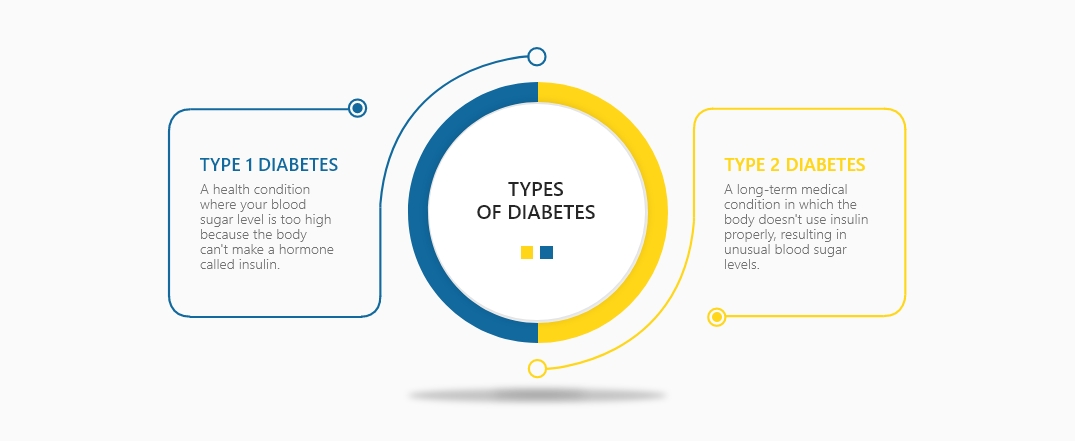

Diabetes can cause damage to the kidneys, heart, blood vessels, eyes, and nerves. The condition interferes with insulin production. Low or no insulin production can lead to glucose accumulation in the bloodstream, and an inability to use insulin effectively can cause various health problems. There are three most common types of diabetes:

Those who have Type 1 diabetes cannot produce insulin in their bodies. Their immune system targets and kills the insulin-producing cells in the pancreas. Although it can develop at any age, Type 1 diabetes is typically diagnosed in infants and young people. To stay alive, individuals who have Type 1diabetes must take insulin every day.

It is the most prevalent kind of diabetes. If you have Type 2 diabetes, you may have poor insulin production or usage. Type 2 diabetes can strike anyone at any age, even in infancy. However, those in their middle years and older are most likely to develop this kind of diabetes.

Gestational diabetes develops during pregnancy. But in most cases, it disappears after the baby’s birth. However, if you have gestational diabetes, your risk of getting Type 2 diabetes in the future is higher. Type 2 diabetes can occasionally be detected during pregnancy.

Diabetes health insurance is beneficial for:

Having the right health insurance for diabetes in India has the following benefits:

For people seeking health insurance with diabetes, several personalised plans are now available that address the unique medical requirements of those living with the condition. Here’s what makes our Care Freedom policy stand out:

Cashless Healthcare Facility

We offer cashless treatment to insured individuals in a vast network of 22100+ healthcare providers.

No Pre-policy Medical Check-ups

Under Care Freedom, you don't need to do diagnostic tests before availing of the insurance benefits. No matter your age or health problems, you can issue the policy without any delays in medical checks.

Recharge of Sum Insured

Don't worry if the claim amount exceeds the coverage limit of your health policy. The basic sum insured will be automatically recharged under Care Freedom so that you or other insured members can use it for further claims.

Life-long renewability

Looking forward to continuing your diabetes health insurance plan for an extended period? You can quickly renew your policy for lifelong coverage as per the applicable policy terms.

Free Look Period of 15 days

In case you disagree with any policy term or wish to upgrade the policy benefits, then you can avail of the benefits of the free-look facility. The Freelook facility gives you 15 days to check the policy details thoroughly and file an easy return in case of any dispute.

Care Freedom is an absolute protective cover for your finances when caring for a diabetic and high-BP family member. Health insurance for diabetic patients in India is indispensable due to the sedentary lifestyle. It safeguards your savings and shares the burden of hospitalisation in times of contingency.

Having multiple health issues is overwhelming, not only physically but financially, too. Given your challenges, we ensure you don't face any problems with the best diabetes health insurance plan in India. We offer long-term care through our lifelong policy renewal facility. Mentioned below is the scope of coverage under our health insurance plans for diabetes:

Exclusions are conditions that are not covered by health insurance for diabetic patients. Understanding exclusions helps to avoid surprises and make informed decisions. Below are some exclusions of a diabetes insurance policy:

Medical expenses incurred for diabetic footwear, crutches, glucometers/thermometers, ambulatory devices, and external durable medical equipment, such as wheelchairs, belts, collars, splints, and walkers

**Please read the policy terms and conditions for further detailed information on exclusions and permanent exclusions.

Add benefits help to updagare the basic policy coverage under duabetes health plan. Here are few add-ons offered under Care health insurance with diabetes:

Health insurance plans for people with diabetes help safeguard them in emergencies. Our diabetes healthcare plan includes the following eligibility criteria:

Entry Age - Minimum

Filing a claim for diabetes health insurance with us is quick and easy. Just follow the below steps to claim the policy hassle-free:

| Cashless Claim | Reimbursement Claim |

|---|---|

| Emegency case-Intimate us within 24 hours Planned hospitalistaion-48 hrs before admission. | Notify us about the hospitalisation. |

| Fill the pre-authorisation form and send it to us for approval | Pay the bills upfront and fill up the reimbursement claim form. |

| Upon approval, avail cashless diabetes treatment from the hospital | Submit the form along with required documents such as discharge summary, medical bills, diagnostic reports etc. |

| We will settle the bill directly with the hospital. | We’ll verify the documents and reimburse the claim amount upon approval. In case of claim rejection, the reason will be communicated accordingly. |

Purchasing a diabetes health policy with us is a simple process. Follow these simple steps to get our policy online hassle-free:

Complete your purchase by paying. The policy documents will be sent to your registered email address and phone numbers.

When buying health coverage for yourself or your entire family, it is essential to carefully review all the benefits and offerings under a given policy. Every family member's health condition may differ, from that of a heart patient to someone who goes through all the benefits and offerings under a given policy. The health condition of every family member may differ, with one being a heart patient to another with weight issues. While comparing health insurance online, you should consider maximum coverage for members with pre-existing diseases.

It is crucial to compare mediclaims based on all the expenses related to pre-existing conditions, especially for obese, diabetic, and high-BP patients. You should carefully compare the coverage for hospitalisation expenses, doctor's consultations, COVID-19 treatment, domiciliary care, daycare treatments, and other allowances for non-medical costs. These minor medical costs for pre-existing ailments snowball into a huge amount yearly.

With Care Freedom, we make your comparison of pre-existing disease health covers easier by offering comprehensive coverage from hospitalisation to consumable allowances for diabetes, hypertension, and high BMI patients. Here's how online comparison of pre-existing disease covers helps you-

At Care Health Insurance, we ensure precise communication of all the policy terms across our website. While studying our medical plans for diabetes and blood pressure treatment, you can find a clear description of covered expenses and benefits to help you understand policy terms easily.

Digital comparison of pre-existing diseases helps you evaluate and choose the best health insurance plans for diabetics and blood pressure health cover from the comfort of your own place. Also, at Care, we facilitate a digital premium calculator to help you approximate the cost of diabetes health insurance while customising your plan with members and add-on covers.

Comparing health plans online lets you review the policy details anytime, anywhere. With complete online transparency, Care equips you with every mediclaim detail from issuance to claim settlement so you can better select the right medical cover for your diabetes and BP treatment.

Managing diabetes, high blood pressure, and obesity demands constant ongoing care and financial planning. Opting for the best health insurance plans can provide the necessary financial support. Understanding coverage specifics and comprehending policy terms and conditions is important to avoid confusion.

Care Health Insurance helps individuals manage lifestyle illnesses such as diabetes by providing comprehensive coverage without requiring pre-policy medical tests, with its best health insurance plans for diabetes. Here is how our products help people deal with diabetes:

Look for hospitals around you

Yes, a high BP, diabetic, or hypertension patient can get health insurance. Care Freedom is specially designed for people with pre-existing diseases such as hypertension & diabetes without a pre-policy medical check-up so that they can afford the best treatment and stay healthy.

Yes, as a standard, people with pre-existing ailments need to bear 20 or 30% of the final claim amount payable. We shall pay the remaining amount up to the sum insured. However, you may opt for a co-payment waiver benefit by paying a slightly higher premium according to policy terms and conditions.

A diabetes health insurance plan is a health cover designed particularly for people suffering from lifestyle diseases such as diabetes, hypertension and high BMI. It provides complete cover for various expenses related to these diseases after the waiting period. The coverage includes in-patient care, daycare treatment, pre-and-post hospitalisation expenses, consumable allowance, ambulance cover, domiciliary hospitalisation, and dialysis procedure.

The procedure for getting a claim for diabetes mediclaim policy is effortless. The insured has to submit a duly-signed claim form and essential documents like hospital bills for reimbursement claims. In case of a cashless claim, we will directly pay your bills to the hospital. Also, the policyholder should inform the insurer as per a specified time for emergency and planned hospitalisation.

If you have been diagnosed with diabetes, High BP, or if you are obese, then buying a health insurance policy for these pre-existing conditions will be helpful. It is essential as the costs of healthcare services in India are getting expensive, especially in private healthcare centres. A health policy will reserve your savings and help you access the best treatment without hassle.

You can easily buy the mediclaim for high BP online. Go to the Care Health Insurance website, click "Care Freedom," and enter your details on the form. You get the quote with a premium amount. You can pay online through our secure payment gateway and get the policy document online.

Care Freedom Plan is one of the comprehensive health insurance for BP and diabetic patients. The waiting period for pre-existing diseases is 24 months.

No, a pre-policy medical check-up is not essential to get the best health insurance for diabetics in India. However, the underwriter may ask to go for a pre-medical policy check-up in some cases.

Yes, Care offers the best health insurance for diabetes in India, with a vast network of over 22100+ cashless healthcare providers.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services:

8860402452

Live Chat

Care Freedom : UIN - RHIHLIP21519V022021

Disclaimer: Information above is just for reference. Kindly read T & C of policy thoroughly, Do refer IRDAI guidelines for tax exemption conditions.

~Tax benefit is subject to changes in tax laws. Standard T&C Apply

~~Claim Settlement Ratio for the period April 2025 to Dec 2025

**Number of Claims Settled as of Dec'25

*Premium calculated for an individual (Age 18) for sum insured 3 Lakhs in Zone 2 cities, 10% discount is applicable for a 3-year policy.

^^Number of Cashless Healthcare Providers as of Dec'25

^The premium is calculated for an insured individual (18) who opts for a sum insured of 3 lakh in a zone 3 city.