Save tax up to ₹75,000~ u/s 80D

Save tax up to ₹75,000~ u/s 80D

The Health Insurance Claim Settlement Ratio refers to the percentage of claims that an insurance company settles from the total number of claims it receives within a given year. It helps in evaluating the credibility of a health insurance company.

A higher CSR indicates that the company has a strong track record of settling claims quickly and efficiently. It is a significant factor when selecting a health insurance policy. An insurance company with a CSR above 90% is generally considered more credible.

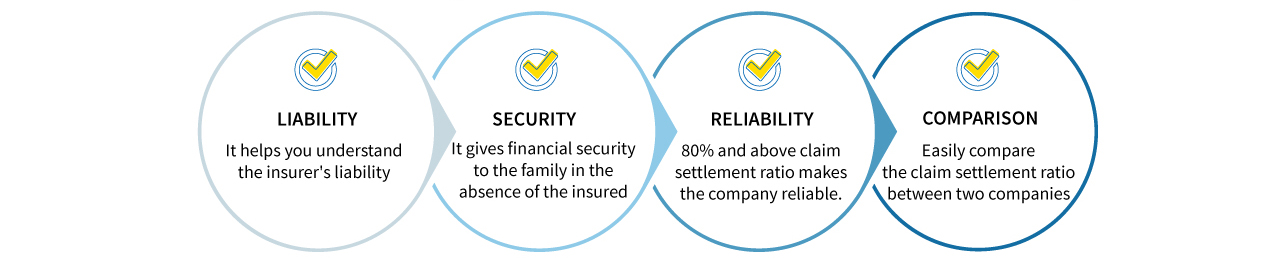

Here are the top reasons that highlight the significance of the claim settlement ratio in health insurance:

The Health Insurance Claim Settlement Ratio is calculated using the formula below:

Claim Settlement Ratio = (Total Number of Claims Settled / Total Number of Claims Received) x 100

Here, "total claims settled" refers to the number of claims successfully resolved by the insurer, and "total claims received" is the total number of claims filed by policyholders within a specific period.

For example, if an insurance company receives 200,000 claims in a year and settles 196,500, the CSR would be calculated as: (196,500 / 200,000) x 100 = 98.25%.

Here’s a list of documents required for claim settlement:

Here are the top factors affecting claim settlement ratio:

Claims may be delayed or rejected if required documents, such as hospital bills, ID proofs, or medical prescriptions, are missing. Ensuring all relevant documents are provided is crucial to avoid claim processing issues.

Permanent exclusions, such as self-inflicted injuries and cosmetic surgeries, are not covered under insurance policies. It is important to review the list of exclusions before purchasing a policy to avoid claim rejections.

False claims are immediately rejected by insurers upon detection. This negatively impacts the insurance company's overall CSR. Therefore, providing accurate medical and policy-related details is essential for smooth claim approval.

Most insurance companies have a time limit for claim submission. Late claim filings can lead to rejection. Thus, it is important to file claims promptly and track the process with the insurer.

Insurers with a faster and more transparent claim settlement process tend to have a higher CSR. Therefore, reviewing the past claim settlement records of insurers before purchasing a policy ensures a smoother claim process.

The following table outlines the key differences between CSR and ICR:

| Factor | Claim Settlement Ratio | Incurred Claim Ratio |

|---|---|---|

| Definition | Represents the number of claims approved and settled by an insurance company. | Amount of money spent by an insurer on claims compared to the premium collected. |

| Importance | Indicates the likelihood of a claim being approved. | Indicates the financial stability of the insurer. |

| Ideal Range | Above 95% is considered ideal. | Between 70 to 90% is considered ideal |

| Reported by | Insurance Regulatory and Development Authority of India IRDAI | Insurance Regulatory and Development Authority of India(IRDAI) |

Here are several ways to check the health insurance claim settlement ratio of an insurer:

The Insurance Regulatory and Development Authority of India (IRDAI) publishes the claim settlement ratios of all health insurance companies in India in its annual report. You can visit the IRDAI website and download the latest report to compare the CSRs of different insurers.

Most insurers provide their claim settlement ratio on their official websites, typically under the "Claims" or "Claim Process" section. Reviewing this data helps you understand their track record of settling claims.

Reading customer reviews on platforms like Google, forums, and social media can provide insights into real-life claim experiences. This information can help you choose an insurer with a higher claim settlement ratio.

Here are ways you can enhance your chances of a smooth claim settlement:

At Care Health Insurance, we are committed to serving our customers to the best of our abilities. Our primary objective is to provide comprehensive healthcare coverage when our customers need it most.

With an extensive network of 21,700+ cashless healthcare providers, we ensure access to quality healthcare while processing claims in under 2 hours. Choose us for a seamless claim experience and dependable support when you need it most.

Look for hospitals around you

A good health insurance claim ratio is typically above 80%, showing a high possibility of claim approval.

You can get the claim forms and a list of documents for submission by visiting Care Health Insurance's official website. The forms are available under the 'Claims' section on the website.

Policyholders must submit all the relevant documents to ease the verification process, prevent delays or rejections and ensure a smooth claim settlement.

A policyholder can make multiple claims in a year as long as they don’t exceed the policy’s sum insured.

If it is a cashless claim, we settle your bills at the time of discharge from the hospital after the insurer’s approval. For reimbursement claims, the documents must be submitted within 15 days of the discharge and the claim will be processed after verification and approval.

TAT for claim settlement varies as per the type of insurance policy, the complexity of the claim and the internal process of the insurance company. According to IRDAI, insurers typically have a TAT of 30 days to settle the claim from the date of receipt of all the necessary documents.

If you have multiple health insurance policies, you can choose from which insurer you can claim from. If your claim is more than the policy coverage, the remaining amount can be claimed from the second insurer, following the contribution clause if applicable.

Information related to the list of network hospitals, claim settlement process and grievance mechanism can easily be found at the insurer’s website.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services: 8860402452

Live Chat

Ultimate Care: UIN - CHIHLIP25044V012425

^^Number of Cashless Healthcare Providers as of Feb 2025

**Number of Claims Settled as of Dec 2024

^10% discount is applicable for a 3-year policy