Save tax up to ₹75,000~ u/s 80D

Save tax up to ₹75,000~ u/s 80D

Cancer insurance is a specialised health insurance policy that provides financial coverage during cancer diagnosis and treatment. It covers medical bills, hospital stays, medications, and even non-medical costs like travel and accommodation.

The best cancer insurance plan covers the cost of surgery, chemotherapy, radiation therapy, and hospitalisation. Cancer insurance in India also offers additional benefits such as premium waivers, income benefits, and coverage for related medical expenses. These benefits can provide further financial relief and support during a challenging time.

Our Cancer Mediclaim Health Insurance policy offers indemnity coverage for cancer-related treatment expenses which means you shall be offered coverage for specific incidents as per the specified policy terms and conditions. Under Cancer Mediclaim, no other diseases would be covered.

But if you are looking for comprehensive coverage other than cancer, then choose from Ultimate Care, Critical Illnesses, Care Supreme, Care Advantage, and other. You can select from our best-selling health insurance covers:

Every year, over seven lakh people are diagnosed with cancer in India, and another five to six lakh people lose their lives to this life-threatening condition. Studies anticipate that India might witness over 17 lakh new cancer patients by 2035 and 12 lakh deaths yearly. The alarming facts and unprecedented health conditions are the primary reasons you should opt for cancer treatment insurance. Other critical reasons to buy a cancer insurance plan are:

Increasing Cancer Cases

Cancer is the leading cause of death worldwide, pointing to the need for early detection, timely treatment and care.

Expensive Treatment Cost

Cancer health insurance in India costs can reach lakhs, and sometimes beyond; thus, you need suitable coverage and security for a lifetime.

High Risk of Ailments

Older people are most vulnerable to the risk of cancer due to age-related ailments and weaknesses that must be covered.

Financial Struggles

Cancer is a terrifying condition that pushes people into economic and emotional turmoil that can be avoided with a mediclaim plan.

Family History of Cancer

If you have a family history of chronic or heavy chain diseases, you should opt for the best cancer insurance plan in India.

Here are some prominent features of cancer medical insurance offered by Care Health Insurance:

| Features | Care Cancer |

|---|---|

| SI Options | ₹10,25,50,100 & 200L |

| In-Patient Hospitalisation | Up to SI |

| Day Care Treatment | Up to SI |

| Advanced Technology Methods | Up to SI |

| Pre-Hospitalisation | 30 days before hospitalisation |

| Post-Hospitalisation | 60 days after hospitalisation |

| Ambulance Cover | Up to ₹3000/ Hospitalisation |

| Organ Donor Cover | Up to SI or 15 L, whichever is lower |

| Chemotherapy and Radiotherapy Cover | Up to SI |

| Alternative Treatments | Up to SI |

Cancer Health insurance works on the same indemnity principle as other health plans, with a fixed sum insured for a payout of regular premium amounts. One can buy a cancer cover individually for a tenure of 1, 2, or 3 years. The foremost step is determining how much coverage suits you based on your health status and budget. Once you choose an adequate sum insured in a cancer health insurance policy, you can file for a cancer-related claim after completing the required waiting period of 90 days and 3 years for those pre-existing diseases.

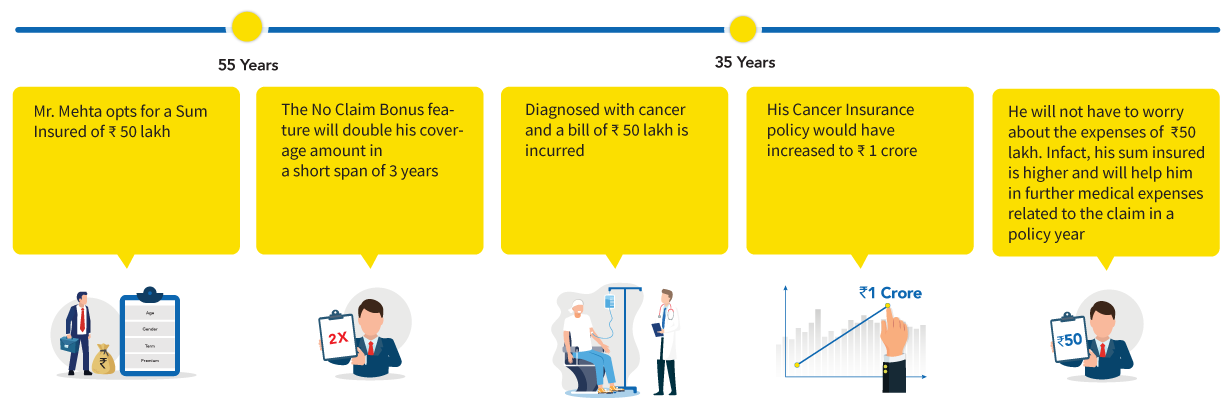

You can also pay the premium quickly with monthly or quarterly instalments after choosing cancer insurance in India. For maintaining a claim-free year, a No Claim Bonus of up to 100% is offered as a reward. The example below helps you learn more about how health insurance cancer coverage works.

People below 50 are eligible to secure their lives with the best cancer insurance plan by Care Health Insurance. Here are some other crucial cancer policy details:

| Cancer Insurance Plan Details | |

|---|---|

| Minimum Entry Age |

|

| Maximum Entry Age | 50 Years |

| Exit Age | No Bar |

| Cover Type | Maximum 6 Persons on Individual Basis |

| Tenure | 1/2/3 Years |

| Pre-policy Medical Check-ups | No Medicals Required |

| Sum Insured Options | 10 Lakhs to 2 Crores |

A Cancer Insurance Plan is a specialised health policy designed to help manage the financial impact of cancer, from diagnosis through treatment and recovery. Check out the wide-ranging coverage and benefits of the cancer mediclaim :

Before you buy a plan, it is essential to read the policy documents thoroughly and be informed about the following exclusions:

Filing a claim under health insurance for cancer mediclaim is similar to filing a claim under your standard health plan. At Care Health Insurance, you can quickly raise a cashless or reimbursement claim by following these steps:

Please note that you must inform our claims team within 24 hours in case of emergency hospitalisation and 48 hours before any planned hospitalisation.

| Cashless Claim Process | Reimbursement Claim Process |

|---|---|

| Step 1: Go to a listed in-network hospital. Step 2: Fill out the pre-authorisation form at the insurance desk. Step 3: Send the completed form to our claim management team. Step 4:When your claim is verified, you'll get an approval letter. Step 5: Respond to queries from the claim management team. You will get information as soon as your claim gets approved or rejected within the standard TAT. |

Step 1: Get the treatment done from a non-network hospital and pay the bills. Step 2: Submit your reimbursement claim form and other required documents along with the discharge certificate. Step 3: Once the verification is done, the policyholder will get the approval. Step 4: The policyholder will receive the approved claim amount in their bank account within the stipulated timeline. Step 5: Our claims team will contact you if there are specific reasons for rejecting your claim. |

Cancer is a dreaded disease that requires quality medical care. Care Health Insurance cancer cover provides a safety cushion that ensures smooth recovery beyond the post-hospitalisation period. Being one of the best cancer health insurance plans in India, the policy covers all types of cancer, including-

Care’s cancer treatment insurance has comprehensive benefits that would help you when you need financial assistance while treating any cancer.

Care’s medical insurance for cancer survivors and healthcare policies work on the same principles of indemnity, yet differ concerning coverage, sum insured options, and eligibility. Also, you may be insured under a standard health cover, but would still need a separate health insurance for cancer to ensure protection against cancer-related medical expenses. Here, read about the significant differences between the two plans:

| Factors | Cancer Insurance | Health Insurance |

|---|---|---|

| Coverage | A dedicated cancer health insurance plan covers all incurred medical expenses related to cancer. | Covers the general medical and surgical costs of multiple diseases . Hospital costs are covered, and there may be sub-limits for room rent, etc. |

| Who Should Buy? | Individuals with higher risks should consider India's best cancer insurance plan in India. In addition to a basic policy, you can buy a cancer care policy to supplement the protection. | Everyone should purchase a standard health policy, regardless of age. With rising healthcare prices, health insurance should be a priority in one's financial plan. |

| Why Should You Buy? | A regular health plan could be insufficient in the event of a serious illness or cancer. As a result, critical illness and cancer coverage are needed. It covers the medical insurance for cancer survivors' expenses, which can be financially challenging. Also, the compensation under a cancer insurance plan can be used to pay off other financial liabilities. | It is a simple indemnity-based plan that reimburses medical costs or provides cashless health care. It is ideal for covering rising hospitalisation costs, care, diagnosis, medical assistance, and other medical expenses, thus enabling one to bear the impact of medical inflation. |

It is essential to purchase a comprehensive and best cancer insurance policy, such as the one provided by Care Health Insurance. Cancer insurance outperforms most healthcare plans because it is low-cost and covers all stages of cancer.

Once you have chosen the right cancer insurance plan for yourself or a family member, you can buy the policy online in the following steps:

Step 1

Generate the quote for the best cancer health insurance by visiting Care Health Insurance’s official website.

Step 2

Fill in the information about insured members, their age, health condition, and gender.

Step 3

Customize your policy by selecting a suitable sum insured, policy period, and premium payment options.

Step 4

Pay the cancer policy premium using a secure digital payment method, such as net banking, debit, or credit card.

Once approved, you will receive the policy documents at your registered e-mail address, including the e-health card.

Here are some of the benefits of buying cancer insurance in India online:

Buying cancer health insurance in India can be overwhelming, especially when you are unaware of the types and extent of expenses incurred toward cancer treatment. While choosing suitable cancer insurance, here are the crucial things that you should consider:

Cancer care management often involves managing long-term healthcare conditions and incurring growing expenses. Thus, selecting a renowned and trustworthy best cancer health insurance in India is a wise and stress-free solution. Here's why Care Health Insurance stands out among others:

Cashless claim settlements are a cornerstone of the modern insurance landscape, offering numerous benefits to policyholders and the industry alike. Irdai in a master circular released on Wednesday alerted all insurance providers...

Read moreHealth insurance premiums are on their way up. A survey of 11,000 owners of personal health insurance policies by LocalCircles found that 52 per cent had witnessed an over 25 per cent increase in their renewal premiums in the past 12 months...

Read moreHealth Insurance for senior citizens: The recent amendments by the Insurance Regulatory and Development Authority of India (IRDAI) regarding health insurance rules are set to benefit senior citizens significantly...

Read moreAs we celebrate Mother’s Day, it is crucial to reflect on the health-related challenges that women face. From reproductive health to mental wellness, our mothers can encounter obstacles that demand attention, care and support...

Read moreCancer Coverage: Ever increasing number of cancer cases in India present a challenging aspect of the nation's healthcare landscape. According to the National Cancer Registry Programme, India recorded about 1.46 million new cases of cancer in 2022....

Read moreA growing number of health insurance customers are nowadays supplementing their base health insurance policies with riders. According to insurance aggregator Policybazaar.com, while only 15 per cent of customers purchased riders...

Read moreLook for hospitals around you

Yes, you would need separate cancer insurance since your basic medical policy may not cover the treatment cost of cancer. There will always be limitations in a standard health plan, which may not allow you to avail of the treatment that caters you complete coverage of your cancer treatment.

Yes, you will be entitled to a maximum of 50% no-claim bonus throughout the cancer treatment policy tenure as a reward for not requesting any claims.

Our cancer care policy is an indemnity-based health plan. We will cover the actual medical costs you incur during your cancer care within the policy period on a reimbursement or cashless basis, subject to policy terms and conditions.

Our cancer insurance plan offers sum insured options ranging from Rs 10 lakh to Rs 2 crore. You can enhance the coverage with optional benefits like unlimited automatic recharge, air ambulance coverage, and room rent modification at an additional premium, thus enhancing your health coverage.

The reimbursement process under our insurance plan for cancer is easy and quick. Our in-house claims management team will address and process your claim within 15 days of receiving your request. Also, the team will keep well-informed about any discrepancies in the documents submitted. The final claim is settled or denied (as per the policy terms) within 30 days of receiving all the documents.

No, a medical check-up is not mandatory before purchasing insurance for cancer coverage. However, policyholders may need to undergo a few examinations depending on their health status and at the underwriter’s discretion.

According to Section 80D of the Income Tax Act of 1961, an individual who purchases cancer mediclaim is entitled to receive an income tax deduction on the premium charged for it. These tax advantages are subject to changes in the tax laws in India.

When choosing the best cancer care policy, you should choose a sum insured that is large enough to cover the different medical expenses you will face in the future. It will cover hospital costs, medical tests, and medicines, among other things.

You cannot opt for cancer insurance or mediclaim for existing cancer patients. To opt for a cancer plan, you should check the policy eligibility and disclose your medical history honestly.

Cancer insurance costs depend on several factors like the sum insured, your age, optional benefits, etc. Before purchasing a cancer insurance plan, review the policy benefits, waiting period, and entry age, and check the applicable premium.

If you cannot pay the premium for your cancer insurance policy on the due date, a grace period of up to 15 days will be allowed depending on the policy terms. During this grace period, you can pay the premium for your cancer care policy without any penalties. However, if you fail to pay the premium after the grace period has ended, it will lead to a policy lapse.

The cancer insurance plan offers lifetime renewal option to the policyholders. You can renew the policy online in a few easy steps. Access Care Health Insurance official website and go to the renew section. Enter complete details and make premium payment through any secure payment mode.

You will have a grace period, which is generally 30 days from the policy's expiration date, to renew the cancer cover plan, subject to the policy terms and conditions.

The coverage for different stages of cancer depends on the cancer insurance plan. It can vary depending on the extent of healthcare required to treat the condition.

Yes, you can buy cancer insurance for your family members, either by adding them to your policy on an individual basis or by purchasing a standalone policy for them. Refer to the terms and conditions of your chosen plan with cancer cover for more details.

It is not possible to get cancer insurance for pre-existing cancer patients.

As the cost of medical treatment is at an all-time high and only expected to increase in the coming future, it is best to opt for a higher sum insured. You should carefully assess your financial profile and health history before arriving at the adequate sum insured for the cancer insurance. Generally, anywhere 50 lakhs above is a favourable amount for a cancer insurance plan.

A: Yes, the product is indemnity-based and designed to cover cancer treatment across stages including surgery, chemotherapy and radiotherapy.

Answer: Yes, the plan offers a Second Opinion benefit once per policy year for specified critical illnesses. If your Sum Insured is ₹50 Lakh or above, you are eligible for an International Second Opinion (Optional Benefit).

Answer: Yes, if you opt for a high Sum Insured. Global Coverage is available for policies with a Sum Insured of ₹1 Crore and above as an optional benefit.

Answer: Yes. The plan includes "Quick Recovery Counseling." This benefit covers psychometric counseling for the insured member to help deal with trauma post-hospitalisation.

Answer: Yes, but this is an optional benefit available for policies with a Sum Insured of ₹50 Lakh and above. It covers up to ₹5 Lakhs from the Sum Insured if a Medical Practitioner certifies the necessity of the Air Ambulance services during a medical emergency.

A: Yes. The plan offers an annual health check-up and a No Claim Bonus that can increase your Sum Insured by up to 100%. Optional benefits may include Air Ambulance, International Second Opinion, and Quick Recovery Counselling after hospitalisation.

A: The plan covers cancer-related hospitalisation (in-patient and day care) up to the Sum Insured. This includes treatments like chemotherapy, and radiotherapy. It also covers expenses incurred 30 days before and 60 days after hospitalisation, as well as organ donor costs related to the treatment.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services:

8860402452

Live Chat

Super Mediclaim: UIN - RHIHLIP21374V022021

Disclaimer: Information above is just for reference. Kindly read T & C of policy thoroughly, Do refer IRDAI guidelines for tax exemption conditions.

Underwriting of claims for cancer is subject to policy terms and conditions

*Sum Insured – Rs.50 Lakhs, Age – 18 to 25 years, Monthly Premium Payment Mode including Optional covers included - Room rent modification/ Air ambulance cover/ ISO.

~Tax benefit is subject to changes in tax laws. Standard T&C Apply

**Number of Claims Settled as of Dec'25

#Premium calculated for an individual (Age 18) for sum insured 10 Lakhs, 10% discount is applicable for a 3-year policy

^^Number of Cashless Healthcare Providers as of Dec'25