Top National Parks in Japan

READ THIS ARTICLE

26 Feb 2026

Coverage for life-threatening PED conditions##

Travel insurance for Canada is a specialised policy designed to protect visitors from unforeseen financial burdens during their stay. Given Canada's high healthcare costs for non-residents, international travel insurance offering medical coverage becomes essential. Beyond medical needs, international travel insurance for Canada also offers financial protection for trip cancellations or interruptions, lost or delayed baggage, and other unexpected travel disruptions. Let’s explore the features, coverage, exclusions, claim process, and other essential aspects of the Explore—Canada Travel Insurance Plan in detail.

A trip to Canada becomes more memorable and enjoyable when you have a supportive travel security plan to back you. Below are the key features that complement the Care Travel Insurance Plans for Canada:

| Parameter | Definition |

|---|---|

| Affordable Premium | Healthcare costs in Canada can be nerve-wracking! But that does not imply your travel insurance has to be as expensive! At Care Health Insurance, we ensure your travel coverage fits your budget with an affordable premium. |

| Automatic Trip Extension | Suppose you are stuck amidst a natural calamity, prolonged hospitalisation, or the unfortunate demise of the insured member. In that case, you just have to worry about getting yourself out of the situation safe and sound. At the same time, your best travel insurance for Canada by Care Health Insurance takes care of the prolonged expenses incurred in the situation for up to 7 consecutive days. |

| Cashless Claim Settlement | Care Health Insurance is powered by UnitedHealth Group (UHG), in partnership with Falck. This ensures hassle-free cashless hospitalisations at the vast network of hospitals, even across borders! |

| Extensive Coverage | Whether you are travelling on a vacation, business trip, or for study purposes, comprehensive travel insurance for Canada provides customisable medical and non-medical coverage. |

| Useful Add-on Benefits | Whether you are a frequent flyer or are travelling to participate in sports activities, we ensure that you have additional financial coverage for issues such as sports equipment loss, visa rejection, or burglary in your home country. |

While buying travel insurance from India to Canada is important that you carefully check out the major highlights of the plan. You must assess your needs to decide whether you need a standalone or a family travel insurance coverage. If you are flying to pursue higher education, student travel insurance shall be the best plan to opt for. Further, if you are to travel multiple times during the year, you can opt for an annual policy, whereas a single-trip travel insurance shall suffice if you travel once in a while.

Based on your needs, you can check out the details of Explore-Canada travel insurance for students and other travellers in the table below.

| Description | Explore Canada+ | Student Explore |

|---|---|---|

| Sum Insured | US $ 50K & 100K (Vary according to the premium) | US $ 30K, 50K, 100K, 300K, 500K, and 1000K |

|

Trip Options

|

Yes Yes |

There are fixed policy tenure options of 1 to 24 months available under Student Travel Plans. |

| Entry Age (Single Trip) |

Minimum: Child- 1Day; Adult - 18 Years Maximum: Child- 24 Years; Adult - Lifelong |

Every fixed-tenure policy involves the same eligibility criteria-Minimum: 12 Years, Maximum: 40 Years |

| Entry Age (Multi-trip) |

Minimum: Child- 1Day; Adult - 18 Years Maximum: Child- 24 Years; Adult - Lifelong |

Minimum: 12 Years, Maximum: 40 Years |

*Family option is only available on Single Trip Policies. Please refer to the prospectus for more details on eligibility.

Here’s a breakdown of the most common types of Canadian travel insurance:

Ideal for solo travellers, this plan covers unexpected situations such as medical emergencies, trip cancellations, lost luggage, and accidents that may occur during your solo trip.

If you're travelling with your family, instead of buying separate insurance for each family member, you can opt for family travel insurance that covers everyone under a single policy, making it more affordable and convenient.

It is an ideal plan for students travelling to Canada for higher studies. The plan covers medical expenses, study interruptions, lost belongings, etc., ensuring you can focus on your studies without having to worry about the unforeseen.

Older travellers have specific needs, and this insurance plan is designed to meet those needs. The plan covers unexpected medical costs, life-threatening conditions due to PED, trip cancellations, lost luggage, and other emergencies that could bring halts to your journey.

If you are travelling for the first time or will not take multiple trips during the year, single-trip travel insurance is the right choice to opt for.

This plan offers excellent value if you travel often. It covers multiple trips throughout the year at a lower cost. It is excellent for frequent travellers and can save money by covering several trips with just one policy.

To keep yourself and your family safe during your international trip, it is important that you have individual/ family travel insurance for Canada. That’s why our Explore travel insurance for Canada promises optimum safety on foreign land. However, before buying the Canada Travel Insurance policy, you should be well-versed with the inclusions and exclusions of the policy. Here are some discussed below:

Note: The plan's features, coverage, and claim underwriting are subject to policy terms and conditions. Please refer to the brochure, sales prospectus, and policy documents carefully.

Investing in Canada travel insurance from India unlocks a world of benefits, offering robust financial protection and essential support for unforeseen situations. Here are the key benefits of your Canada travel insurance:

Several factors affect the cost of travel health insurance for Canada from India, including the traveller’s age, destinations covered, trip duration, insured person’s health status, and type of coverage offered. At Care Health Insurance, we offer affordable travel insurance for trip to Canada for visitors, with premiums starting from as low as INR 621~ for a single traveller on a week-long journey.

| Insured Member(s) | Age | Any Pre-existing Disease | Sum Insured | Policy Duration | Premium Amount (approx.) |

|---|---|---|---|---|---|

| 1 | 24 years | No | $ 50,000 | 7 Days | ₹621~ |

*The above-mentioned travel insurance premium is calculated subject to no pre-existing medical conditions of the insured members. It considers that the insured members have not been diagnosed, hospitalised, or underwent any treatment in the last 48 months. Also, the premium amount is subject to change if the insured person has already claimed any travel policy before.

Given the options available, choosing the ideal tourist insurance for Canada can be confusing. Don’t worry, just tick in the following factors while buying a travel insurance plan for Canada to ensure you make the right choice:

You must follow the steps as mentioned below to purchase travel insurance online:

Step 1

Visit the travel insurance quote page. Enter your travel destination and duration. Choose the available sum insured (the amount covered), then click "Buy Now."

Step 2

Complete the KYC (Know Your Customer) process and enter the details of the person buying the insurance. When you're done, click "Next."

Step 3

Enter the information of the person being insured. If anyone has any existing medical conditions, mention them here.

Step 4

After filling in all the details, make the payment. Your travel insurance policy documents will be sent to your registered email and phone number.

If you're an Indian citizen planning a trip to Canada, having the correct documentation is important for a smooth entry. Here's a concise list of what you'll need:

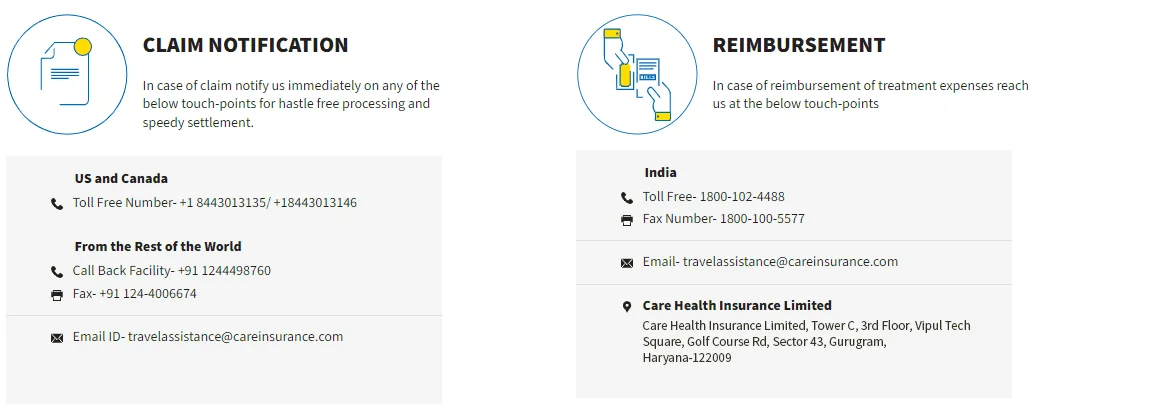

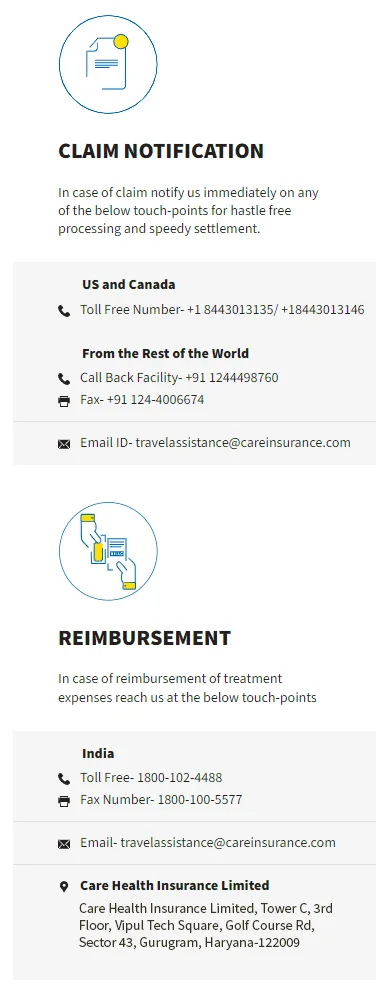

In the USA and Canada, Care Health Insurance is powered by the UnitedHealth Group (UHG) in partnership with Falck to ensure an easy claim process. Our claim team ensures that filing a claim is no longer cumbersome, no matter where you are.

Applying for a Visa for Canada requires you to undergo an exhaustive application process. Below is a detailed step-by-step guide to applying for a Canadian visa:

Step 1: Based on your purpose of visit, fill out an application form (online or on paper). For instance, if you are to visit Canada for business purposes, fill out a form for a business visa.

Step 2: Gather the documents based on the type of visa you require.

Step 3: Visa fees vary depending on the type and duration of the visa. Be sure to check the current fee structure before submitting your application.

Step 4: Visit your local Canada Visa Application Centre with all supporting documents, including your passport and proof of payments.

Step 5: Submit your completed application form if done on paper.

To ensure a smooth and successful Canada tourist visa application, gathering the right documents is key. The general documents you shall provide include:

To fully enjoy Canada's stunning beauty, it is wise to be prepared and take key safety precautions. Here's how to stay safe during your adventure in Canada:

Canadians generally appreciate key social courtesies. Here's a quick guide to standard etiquette:

Canada truly is a country of breathtaking sights and a rich culture, offering something for every type of traveller from majestic glaciers and serene lakes to fascinating museums.

With massive lands, waterfalls, and large urban cities with modern twists, Canada attracts people worldwide. From snow-capped mountains and enormous shorelines to clear lakes that mirror the sky, Canada has it all. So, if you are wondering what all you can do during your trip to Canada, here’s a guide.

Buying the best travel insurance for Canada from India will allow you to experience these wonderful destinations without worrying about unexpected expenses arising from an emergency.

At Care Health insurance, the international travel insurance plan for Canada may not provide a financial coverage in underlying conditions:

Note: Please ensure to read the complete details of exclusion mentioned in the brochure before buying the plan to avoid any exclusions.

Yes, at Care Health Insurance the travel insurance Canada comes with a free look-out period in which, you get 15-30 days to review the terms and conditions of the policy. The duration of days depend on whether you have bought the plan online or through an insurer.

Although the best thing to do while travelling is to get coverage for the complete trip, at a plan bought from Care health insurance also provides you with customisation options. Through customisation, you can cover just a part of your trip at a lesser premium.

Yes, it is possible to buy a travel insurance canada after booking your tickets to the destination. However, there are certain benefits that you may miss out on, if you procrastinate purchasing the plan till later.

Canada does not provide free healthcare to visitors from India. Thus, it is always wise to choose a broad financial cover that can save you from the expensive medical expenses that comes along during the journey.

Yes. If your travel insurance Canada has the option of customisation, you can change the dates of your trip and accordingly change the dates in the travel insurance plans.

Although it is not mandatory to have a travel insurance for the people immigrating to Canada, having a financial cover that can assist you in times of medical urgency can prove as handy.

Explore the Horizons worry-free with Explore!

Sales:1800-102-4499

Services: 8860402452

Live Chat

Disclaimer: The information provided is for reference purposes only. Please refer to the official websites for country-specific information and policy documents for details on plan benefits, coverage, and exclusions.

^^Number of Travellers Served till Dec'25

**Number of Claim Amount Paid as of Dec'25

^Family members on the same policy with the same sum insured receive discounts on the premium of additional members covered: 2 members 5%, 3 members 10%, 4 members 15%, 5 members 17.5%, 6 members 20%.

##The life-threatening pre-existing diseases are covered up to 10% of the sum insured (max. up to $10,000) if disclosed during policy purchase.

&Premium calculated for an individual (Age 18), single trip (90 days) in USA, for sum insured $30,000.