The Union Budget 2023 is around the corner. Releasing on 1st February 2023, this financial budget will likely be the last full-year Budget for the current government before the 2024 general elections. Hence, individual taxpayers have pinned high hopes on the Honourable Finance Minister Nirmala Sitharaman for constructive tax relief.

Budget Expectations

So far, taxpayers have always expected — and to some extent — have reaped favorable capital gains tax structure, housing sector reliefs, and an increase in tax slabs for salaried individuals. However, for the coming financial year, there are many more tax reliefs on the wish list of taxpayers. This includes an increase in income tax exemption for senior citizens and hype in the medical expenses deduction for senior citizens.

In its pre-budget memorandum, the industry body, ASSOCHAM, has recommended raising the total exemption limit for senior citizens to Rs 7.5 lakh this year. With that, the expectations are high for the increase in the minimum tax exemption limit for senior citizens, i.e., people between 60 to 80 years of age. Before we go into the details of expected tax reliefs, we must quickly go through the basic income tax exemption for senior citizens.

Basic Income Tax Exemption for Senior Citizens

The Indian Government has always prudently provided some basic tax deductions for senior citizens on various tax-saving instruments and medical expenses.

80D Deduction on Health Insurance Premium: Senior citizens with health insurance policies can claim tax deductions of up to Rs 50,000 u/s 80D of the Income Tax Act on the premiums paid. Also, children who pay the premium on behalf of their elderly parents — can avail of the 80D deduction.

80D Deduction on Health Expenses Incurred: The tax rules provide tax relief to senior citizens not covered under any health insurance policy. Such individuals are entitled to a tax deduction of up to Rs 50,000 for medical expenses paid during the fiscal year.

80DDB Deduction on Expenses Incurred for Specified Diseases: The Section 80DDB of the Income Tax Act provides for a deduction to a resident citizen on the expenses paid for the medical treatment of some specified disease for a taxpayer or their dependent relative (spouse, children, parents, brothers, and sisters). These diseases include:

1. Neurological Diseases, where the disability level has been certified to be 40% and above:

- Dementia

- Dystonia musculorum Deformans

- Motor Neuron Disease

- Ataxia

- Chorea

- Hemiballismus

- Aphasia

- Parkinson's Disease

2. Malignant Cancers

3. Full-Blown AIDS

4. Chronic Renal failure

5. Haematological disorders:

- Hemophilia

- Thalassaemia

We shall now discuss all the tax reliefs for senior citizens expected to come in the Union Budget 2023.

Expected Tax Reliefs for Senior Citizens in Budget 2023

In the wake of the global concerns post-COVID outbreak, senior citizens are wary of the steeply rising medical expenditure. Hence, they expect the government to announce tax reliefs on health insurance premiums. According to trusted sources, the following are some of the much-awaited tax sops for senior citizens:

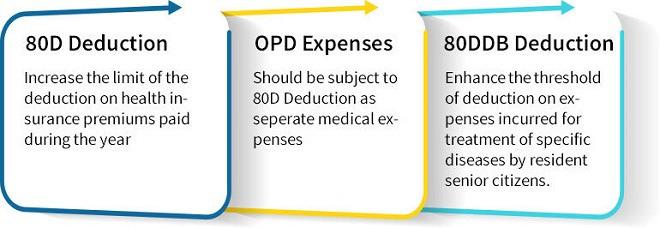

- Increase in 80D Deduction on Health Insurance Premium

- 80D Deduction on OPD Expenses

- Raising 80DDB deduction on medical treatment of senior residents

Increase in 80D Deduction on Health Insurance Premium

Currently, the provisions u/s 80D of ITA apply a deduction of Rs. 50,000 on any Health Insurance premium and medical expenses incurred by a senior citizen. Industry experts have recommended that the government raise the threshold limit to Rs. 1,00,000.

After the pandemic, health insurance premium rates have gone up. Besides, many individuals have enhanced their health coverage, which poses the burden of additional premiums on their pockets. Especially for senior citizens, it becomes difficult to bear premium amounts without any active source of income. These are some reasons why the demand for raising the threshold for 80D deduction has gained traction, particularly after COVID-19. Preeti Zende, the SEBI Registered Investment Advisor and founder of Apana Dhan Financial Services, says,

"If a senior citizen and spouse want adequate, comprehensive cover, the premium amount could go well beyond Rs 50,000. The finance minister should consider raising the 80D limit to Rs 1 lakh."

Ideally, in a country where medical expenses are high, even at government hospitals, many expect the government to provide a 100% deduction against medical expenses with no limit.

>> Also Read - 4 Tips to Minimise the Medical expenses during old age

80D Deduction on OPD Expenses

Health insurance policies generally do not cover outpatient department (OPD) expenses. Many senior citizens suffering from chronic ailments such as diabetes and heart problems require continuous hospital visits, which means incurring OPD expenses every time — amounting to a considerable share annually. To solve this problem, the experts have suggested that the finance minister consider OPD expenses as a deduction u/s 80D of ITA. This deduction should be 100% irrespective of whether the OPD expenses are covered under the health insurance policies.

Luckily, some competitive health insurance plans, such as the Care Senior Plan of Care Health Insurance, provide OPD expense coverage as an optional policy benefit. It supports senior citizens in bearing minor OPD costs that can amount to a significant sum annually. Policyholders can avail of this feature by paying a slightly higher premium amount.

Raising 80DDB Deduction on Medical Treatment of Senior Residents

Section 80DDB of the IT Act provides a deduction to a resident individual with respect to the amount paid for the medical treatment of a specified disease for the assessee or their dependent relative (spouse, children, parents, siblings). The threshold limit for such deduction in the case of senior citizen patients is Rs. 1,00,000.

However, since the last revision was in Finance Act 2018 and the medical cost inflation today, the threshold needs an upward revision to Rs. 1,50,000.

These are some of the proposed medical expense deductions under the Income Tax Act for senior citizens expected to be announced in Budget 2023. Suppose the tax reliefs mentioned above are introduced in the upcoming budget for senior citizens. In that case, the chances will be high for the government to gain the widespread support of nearly 10 percent of the Indian population in the next general elections.

Disclaimer: Please verify the policy details and coverage with the official policy documents. Also, kindly consult a professional medical expert to verify the details of health concerns.