We can understand the disappointment when you are made to pay for the medical bills out of your pocket even after having comprehensive medical insurance.

A health emergency may grip you unprepared. While you would try to receive a cashless healthcare facility, an emergency may land you at a non-network hospital, burdening you with financial stress before filing for reimbursement. That’s why it is essential to learn about how to fill out a health insurance claim form required during the reimbursement process.

We have curated a simplified guide to help you raise a claim request smoothly and get a settlement successfully.

What is Health Insurance Claim Reimbursement Form?

You need to fill out the reimbursement claim form if the hospital where you got your treatment is not empanelled with your health insurance company. The reimbursement form is filled out after the patient is discharged. You must submit the same along with the other documents to the insurer within 15-30 days of discharge.

You can get the Care Health Insurance Claim Form by clicking here.

Parts of the Care Health Insurance Claim Form for Reimbursement

There are two parts of the claims reimbursement form as explained below-

| Part A of the Claims Reimbursement Form | Part B of the Claims Reimbursement Form |

|---|---|

| This part is meant for you, as an insured person, to fill in your contact details and information about your insurance, hospitalisation, and other relevant particulars. | This part is meant for the hospital where you or any other insured member was admitted. The hospital will fill in all the necessary details related to the hospitalisation process, ailment, and claim. |

How to Fill Care Health Insurance Claim Reimbursement Form

You must be careful while filing the claim form, especially if this is your first time filing a reimbursement claim.

To begin with, you can download the Care Health Insurance Claim Form from the website's Self-help portal.

Now, let’s understand how to fill claim form for health insurance step by step -

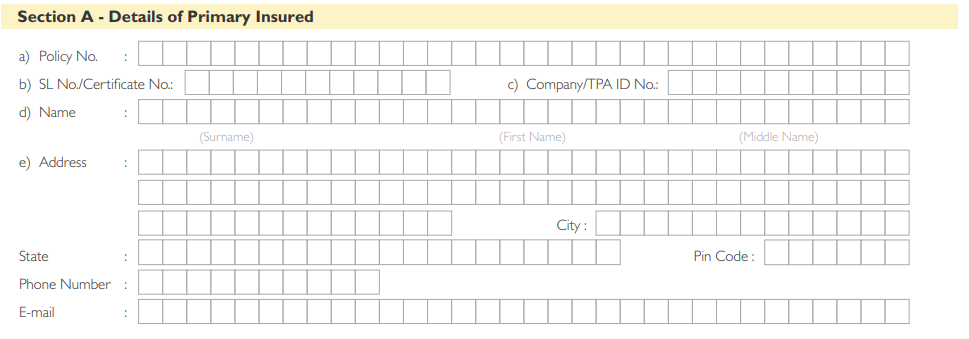

Step 1: Fill Out the Details of the Primary Insured

The first step is to fill out all the information related to the primary insured under your health insurance policy. For instance, the health policy can be registered in your name with your parents listed as beneficiaries.

To fetch the primary insured’s details, you need to keep your policy documents handy and follow the instructions below-

- Here, fill out the policy number as mentioned on your insurance documents.

- As for the TPA number, you can find it here from the authorised IRDAI list of Third Party Administrators (TPAs).

- Below this, enter your details, including your name, address, contact number, and email.

Also Know : What Is Health Insurance

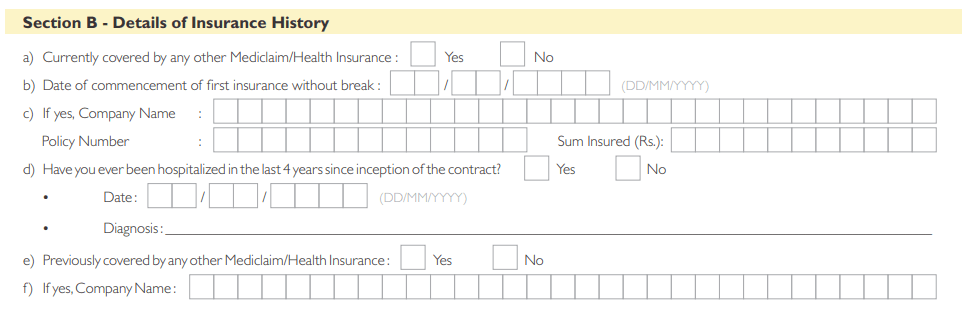

Step 2: Disclose the Insurance History of the Person Filing Claim

The form’s second section requires information about whether the insured patient is covered under any other mediclaim or not. If yes, you must fetch all the details of the other insurance policy, including-

- The Insurer’s name

- Policy number

- Sum insured

- Number of times hospitalised, and

- Previous record of insurance coverage, if any

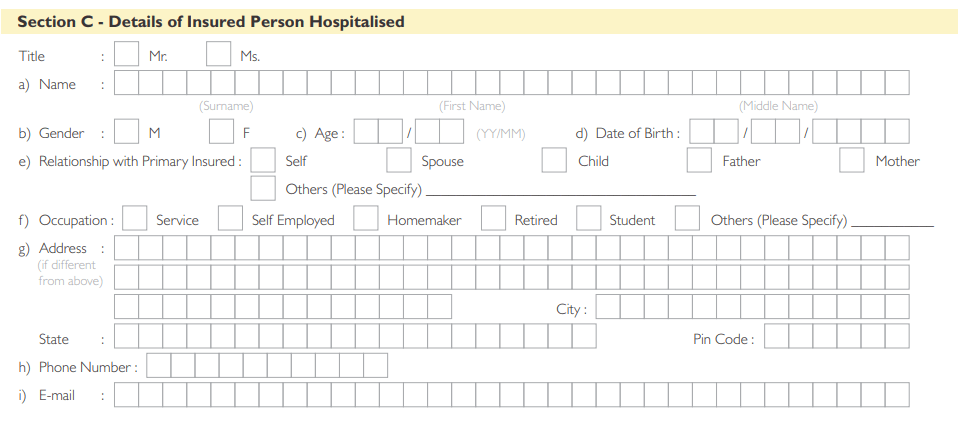

Step 3: List Down the Details of the Insured Person Hospitalized

Under the form’s ‘Section-C,’ you need to fill out all the personal information of the insured member who is hospitalised and for whom you are raising a claim. The particulars include-

- Insured person’s name

- Relationship with the primary insured

- Occupation

- Address

- Contact number, and

Remember, if there is more than one insured member hospitalised, you need to fill out separate claim forms for each of them.

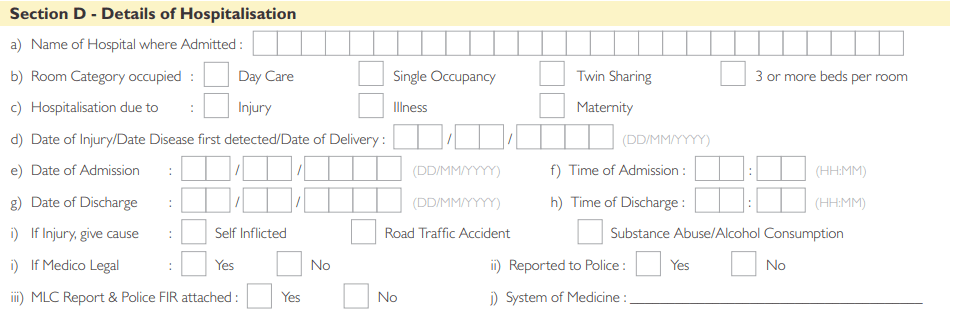

Step 4: Enter the Hospitalization Information

The next step is to enter all the hospitalisation specifics. For this, you need to be well aware of

- The hospital’s name

- The type of room occupied by the insured

- The reason for the insured’s hospitalisation

- The dates of admission and discharge.

- If it’s a legal case, you must also attach the FIR.

In case it is difficult for you to gather this information, you can get help from the hospital’s TPA desk to fill it out.

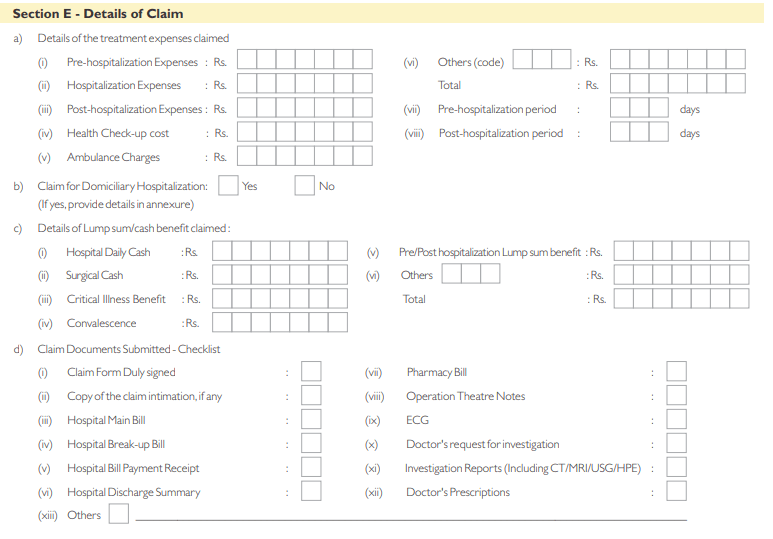

Step 5: Calculate and File the Claim Amount

This is the most critical section of the claims form, requiring the claim details. Make sure you arrange all the hospital bills chronologically (date-wise) before filling out this section. For this, you need to collect and organise these documents-

- All the original hospital reports, from the admission date till the date of filing the claim

- All the original hospital bills, from that of the X-ray and tests to in-patient and pharmacy

- All the receipts of lump sum cash benefit (if any) received from the insurer.

To calculate the treatment expenses in the claim form, follow the category-wise segregation below

- Pre-hospitalization Expenses - Collect all the bills related to tests, medications, and doctor’s consultancy fees that were incurred before admitting the patient to the hospital ward. Sum the bills and enter the total in this field.

- Hospitalisation Expenses - Here, enter the total amount paid when the patient was finally discharged from the hospital. It should be a combined receipt along with a detailed breakdown of all the charges, including room rent, medications, tests, kits, consumer items, etc.

- Post-hospitalisation Expenses - If you have incurred any charges for routine check-ups after discharge, enter the sum total of all such bills up to the filing date in the field.

- Health Check-up Cost and Ambulance Charges - To be filled if applicable.

This section also contains a checklist of the documents you will attach along with the claims form. Tick all that applies.

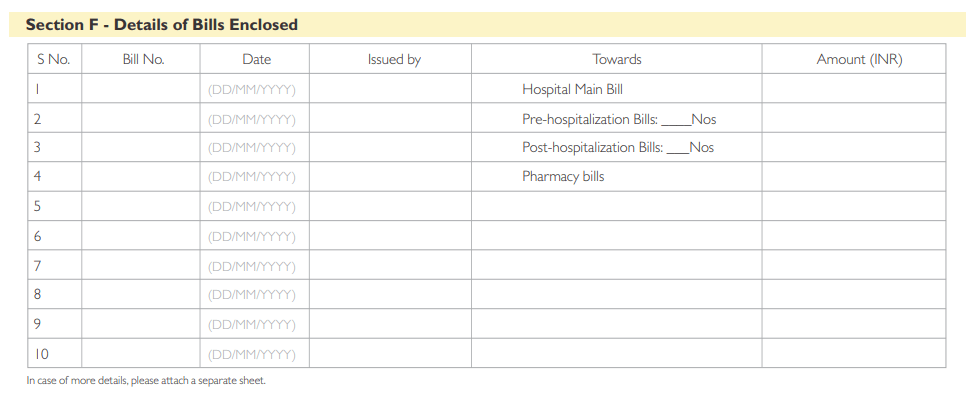

Step 6: Segregate and Explain the Bills Enclosed

This is another critical section that needs your utmost attention. Once you have your medical bills arranged chronologically, filling in this information becomes easy under these four categories-

- Hospital main bill amount

- Total number of pre-hospitalization bills and their sum total

- Total number of post-hospitalization bills and their sum total

- Total amount of the Pharmacy bills

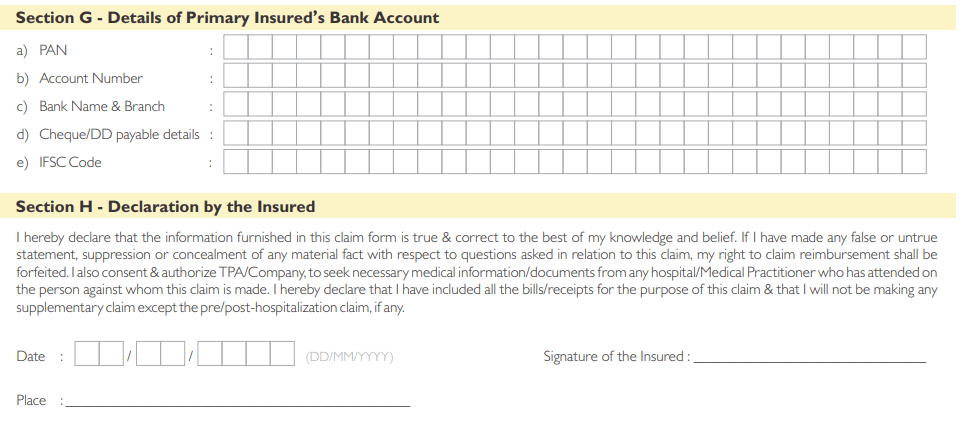

Step 7: Share the Primary Insured’s Bank Account Information

The final step is to enter the accurate bank details of the insured person. You can find this information on the insured's bank cheque. This includes

- Permanent Account Number

- Account Number

- Bank Name and Branch

- Cheque/DD payable details

- IFSC Code

As you reach the end of the claims form, double-check all the information you have filled in. Close the form by adding the insured’s signature and date. Contact the hospital’s TPA desk to complete Part B of the claims reimbursement form.

Once you have completed Part B and the remaining application, you may either upload the claim form and related documents online, visit the nearest branch and submit the documents their or post them at the address below.

Address: Third Floor, Care Health Insurance Limited, Vipul Tech Square, Tower C, Golf Course Road, Sector-43, Gurugram-122009 (Haryana)

When submitting the claim form at the nearest branch, don’t forget to collect the stamped and signed receipt. You must also save the generated claim number when filing an online claim. Moreover, when posting the claim form, ensure the document is properly sealed and has your policy number written on it.

On a Final Note

FFiling a reimbursement claim can be a lengthy process with a lot of queries raised by the insurer. Yet, it is not an impossible task to receive your claim amount through reimbursement. All you need to do is maintain and preserve all the hospitalisation paperwork and bills carefully while constantly staying in touch with the insurer’s claims team.

Here’s when Health Insurance supports you with a quick and effective mediclaim policy claim process through an internal claims management team. With a high claim settlement rate, we promise instant customer support during an emergency to ensure maximum financial security for the insured members. Learn more about our products and services.

Also Know : Family Health Insurance

Disclaimer: Filling out the claim form should not be taken as an admission of liability. The reimbursement process is at the team’s discretion that follows a standard process and set of guidelines.