Subscribe to get weekly insights

Always stay up to date with our newest articles sent direct to your inbox

Published on 27 Jun, 2022

Updated on 28 Jun, 2024

2817 Views

4 min Read

Written by Riya Lohia

favorite0Like

favoriteBe the First to Like

A burn is an injury to the skin that can cause unimaginable pain and may take time to heal according to the degree of burn. Skin burns can cause pain, blisters, peeling skin, swelling, or white/charred skin if not treated promptly. Nearly 1.8L deaths are caused by burns globally, in India itself, over 1 million people are burnt every year. Most cases of burns are caused by to hot curling iron, oven, spilling of hot liquid, electricity, or contact with chemicals.

No matter how cautious you are, you cannot prevent accidental burns, but you may protect yourself from the medical costs associated with them. So, here comes the Personal Accidental Insurance to your rescue! This insurance for burn coverage for skin burns ensures you are financially protected under such circumstances.

To begin with, let’s learn about the classification of burns and how important it is to be covered for Skin Burns under a Health Insurance plan.

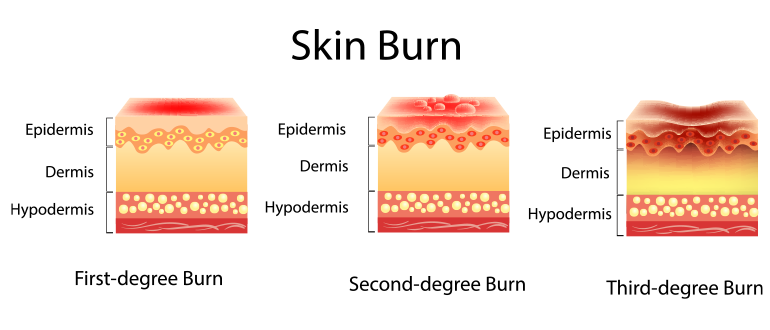

Depending on how deeply and severely a burn penetrates the skin's surface, it is categorised as a first, second, and third-degree burn.

Only the epidermis, or top layer of skin, is impacted by 1st-degree burns. The burn site is painful, dry, and red; no blisters are present. For instance, a minor sunburn. Rare cases of long-lasting tissue injury typically involve changes in skin tone.

Skin's epidermis and a portion of its dermis are both affected by second-degree burns. The burn site looks red, has blisters, and may look unpleasant and swollen.

The epidermis and dermis are destroyed by third-degree burns. The underlying nerves, bones, muscles, and tendons may be injured by third-degree burns. The burnt area looks scorched or white as the nerve endings get damaged and may result in numbness.

Knowing the difference between types of burns will help you understand the severity of the burn more clearly.

Burns that cover 10% of a child's body or 15% to 20% of an adult's body are regarded as serious injuries that necessitate hospitalization and intensive rehabilitation.

Burn injuries require immediate attention and treatment as per the degree of burns. If the burns are minor they can be treated at home and can heal within a week or so. Here are a few treatments that you can follow to heal minor burns:

However, you should always be careful as the above burn treatments may not give you the expected results and could worsen the injury. So, it is suggested to consult the medical expert first if you get a burn. Your doctor will assess the burn’s size and depth before treating it. After examining, he would suggest the treatment for your burn injury depending upon the which could cost a fortune if you are health insurance does not cover skin burns.

Medical or surgical treatment is available for certain skin burns. While some treatments might be inexpensive, others might burn a hole in your pocket. Financial hardship may result from expensive treatments for burn injuries. It seems sensible to buy health insurance that covers accidental skin burns and protects you financially in times of such contingency.

A cover explicitly for skin burns can help you deal with costly treatment with multiple inclusions. We at Care Insurance provide specialized Personal Accident Insurance, which prevents you from a financial crunch in case of any unexpected incidents like burns, fractures, disablements, and any other severe injuries. God forbid if something happens to you, this insurance helps to mitigate the financial burdens such accidents can bring. Ensuring that the policyholder’s family can cope with the financial impact of the event, 100% of the sum insured of the policy is paid to the family. The plan also includes benefits like coverage for accidental death, major diagnostic tests, accidental hospitalization expenses, child education, and more.

It becomes unimaginably distressing to arrange finances when there is an emergency that needs immediate attention. In case of skin burn accidents, one has to be rushed to the hospital without any delay to avoid any infection, severe pain, or complexities. With a Personal Accidental Cover, you would at least have something to back you up financially while you are enduring the immense pain if there is an accidental burn that needs immediate hospitalization. So, don’t wait for the unexpected to happen, buy personal accident insurance and secure yourself and your family’s future today!

>> Also Read: Boost Health Care Cover without Additional Cost on Premium

Disclaimer: The above-mentioned information is for reference purposes only. Refer to your policy documents for more details on Burns.

favoriteBe the First to Like

Thyroid : मामूली नहीं हैं महिलाओं में थायराइड होना, जानें इसके लक्षण और घरेलू उपचार Vipul Tiwary in Diseases

शुगर कंट्रोल कैसे करे? जानें, डायबिटीज में क्या खाना चाहिए Vipul Tiwary in Health & Wellness

हाई ब्लड प्रेशर को तुरंत कंट्रोल कैसे करें? देखें इसके उपाय Vipul Tiwary in Diseases

पैरों में दर्द किस कमी से होता है? जानें, इसके घरेलू इलाज Vipul Tiwary in Health Insurance Articles

What is Scoliosis Disease? - Causes, Symptoms & Treatments Bhawika Khushlani in Diseases

5 Tips on Making the Most of a Health Insurance Top-Up Plan Mudit Handa in Health Insurance Articles

7 Private Health Insurance Waiting Period Traps to Watch Gungun Bhatia in Health Insurance Articles

Buying Health Insurance for Parents? Don’t Miss This Unlimited Recharge Feature Gungun Bhatia in Health Insurance Articles

Always stay up to date with our newest articles sent direct to your inbox

Loading...