Save tax up to ₹75,000~ u/s 80D

Health insurance is a contractual agreement between an individual and an insurance company, where the insurer covers the medical expenses in exchange for a premium. It safeguards your savings during medical emergencies or planned treatments, offering coverage for surgeries, hospitalisation, day-care procedures, pre- and post-hospitalisation expenses, ambulance charges, ICU charges, and more.

A health insurance policy helps reduce the financial burden of healthcare costs and also provides tax benefits of up to ₹75,000 on the premium amount under Section 80D of the Income Tax Act.

In a country like India, where healthcare costs are growing and disease risks are evolving more rapidly than ever, securing the best health insurance plan is no longer a choice; it's crucial. The health landscape demands a shield from heart disease to silent outbreaks of viral infections.

... Read More

Read Less

Finding the ideal health insurance policy requires consideration of both personal and financial factors to guarantee maximum security and value. Here are the factors you need to be mindful of when selecting the best health insurance policy in India:

Let’s assume, Reena resides in a tier-3 city, where the cost of living and healthcare expenses are relatively lower than in a metropolitan city, a health insurance policy of ₹5 lakh may be sufficient to meet her medical needs. However, if Reena lives in a metro city such as Delhi or Mumbai—where the cost of living and medical treatment is significantly higher—it is advisable to opt for a health insurance policy with a coverage of ₹10 lakh or ₹20 lakh.Also, given your needs, a 1 cr health insurance policy is useful in light of medical inflation.

Did you know? Our ₹1 crore health insurance policy lets you claim large amounts without a limit. To know more, check out the plan now!

Here are the main types of health insurance policies for your better understanding:

This health insurance policy covers a single individual against clinical expenses. Perfect for : Young individuals or people seeking independent health coverage.

This policy provides coverage for multiple insured members under a single sum insured. Any member can use the coverage during hospitalisation.

Perfect for: Families seeking comprehensive yet affordable health insurance in India.

This policy covers childbirth expenses, prenatal and postnatal care, as well as newborn baby care.

Perfect for: Couples planning a family.

Designed for individuals aged 60 and above, this plan provides enhanced coverage for age-related diseases and health issues.

Perfect for: Retired people or elderly parents.

This specialised health insurance plan offers coverage to the policyholder when they are diagnosed with a serious illness, such as cancer, stroke or heart disease.

Perfect for: Individuals with a family history of critical illnesses or those seeking additional protection.

A top-up plan increases your sum insured at an affordable premium. In contrast, a super top-up plan provides additional protection over multiple claims. Perfect for: Individuals seeking to enhance their existing medical insurance coverage effectively.

As one of the leading health insurance providers in India, Care Health Insurance offers tailor-made services, swift claim settlements, and a comprehensive range of health insurance plans. Here are some of the key reasons why choosing a policy from us can be the right decision for you:

Having the best health insurance policy isn’t just about covering hospital bills; it’s about securing your mental peace. A well-chosen health insurance plan secures you and your loved ones, preparing them for life’s medical uncertainties. Here are some of the key benefits of choosing the mediclaim policy from us:

Explore key features of our health insurance plans, designed to offer comprehensive medical coverage, financial security, and seamless access to quality healthcare in times of need:

| Features | Details |

|---|---|

| Sum insured | 5 lakh-1 cr. |

| In-patient Hospitalisation | Up to SI |

| Pre-Hospitalisation | 60 days |

| Post-Hospitalisation | 90 days |

| Day Care Procedures | All day care procedures up to SI |

| Unlimited Automatic Recharge | Yes |

| Unlimited e-consultations | Yes |

| Organ donor cover | Yes |

| Ambulance cover | Up to SI |

| Premium payback | Yes |

| Loyalty Boost | Yes |

| Tenure Multiplier | Yes |

Embrace the ease of securing your health online, with our digitally-enhanced portal.All you need to do is simply select your preferred health cover plans, fill up the details, and pay through secure transaction modes. Here’s why and how we ensure a customer-friendly purchase a medical insurance plan online:

Every health insurance plan offers a different mix of benefits, features, and coverage options. To make an informed decision, it is essential to compare how we stand against other health insurers in the market. Here's a clear comparison to help you understand the difference:

| Benefits | Other Health Insurers | Care Health Insurance |

|---|---|---|

| Bonus Coverage | Bonus coverage is generally capped, so the sum insured does not increase significantly over time. | Renewal bonuses are more rewarding, with cumulative or enhanced benefits that increase your sum insured each year. |

| Room Rent Limits | Many insurers apply sub-limits on room rent or ICU charges. | No room rent sub-limits in most of our standard health insurance policies. |

| Co-pay | A fixed co-pay may be applicable based on age, treatment type, or selected sum insured. | Minimal or zero co-pay in most of our plans, enabling higher financial protection for policyholders. |

| Automatic Recharge | Coverage is usually restricted to the base sum insured. Once exhausted, additional top-up coverage may be required. | The sum insured is automatically recharged multiple times in a policy year, ensuring continuous protection. |

| Online Consultation | Only a few insurers provide unlimited online doctor consultations. | Unlimited e-consultations are included, allowing convenient access to medical advice from home. |

| Ambulance & Emergency Services | Ambulance coverage may be limited or allowed only under certain conditions. | Complete and enhanced coverage for emergency ambulance services with 24/7 support. |

As one of the best health insurance companies in India, Care Health Insurance ensures optimum healthcare coverage complemented with an affordable premium. Here are some of our best health insurance plans in India :

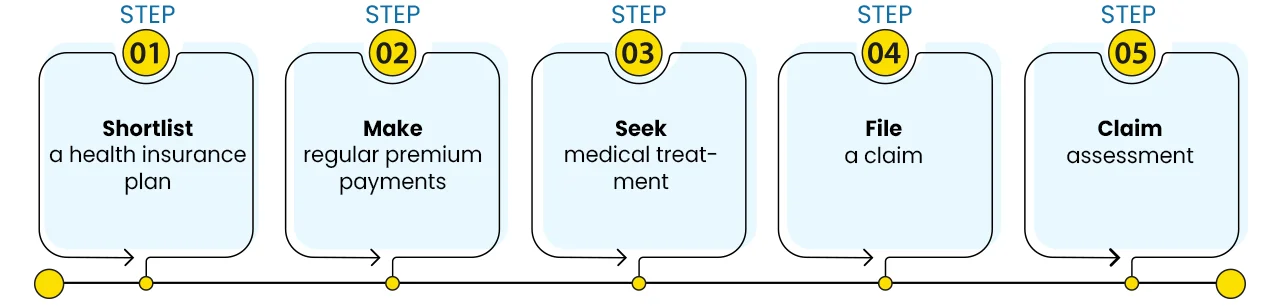

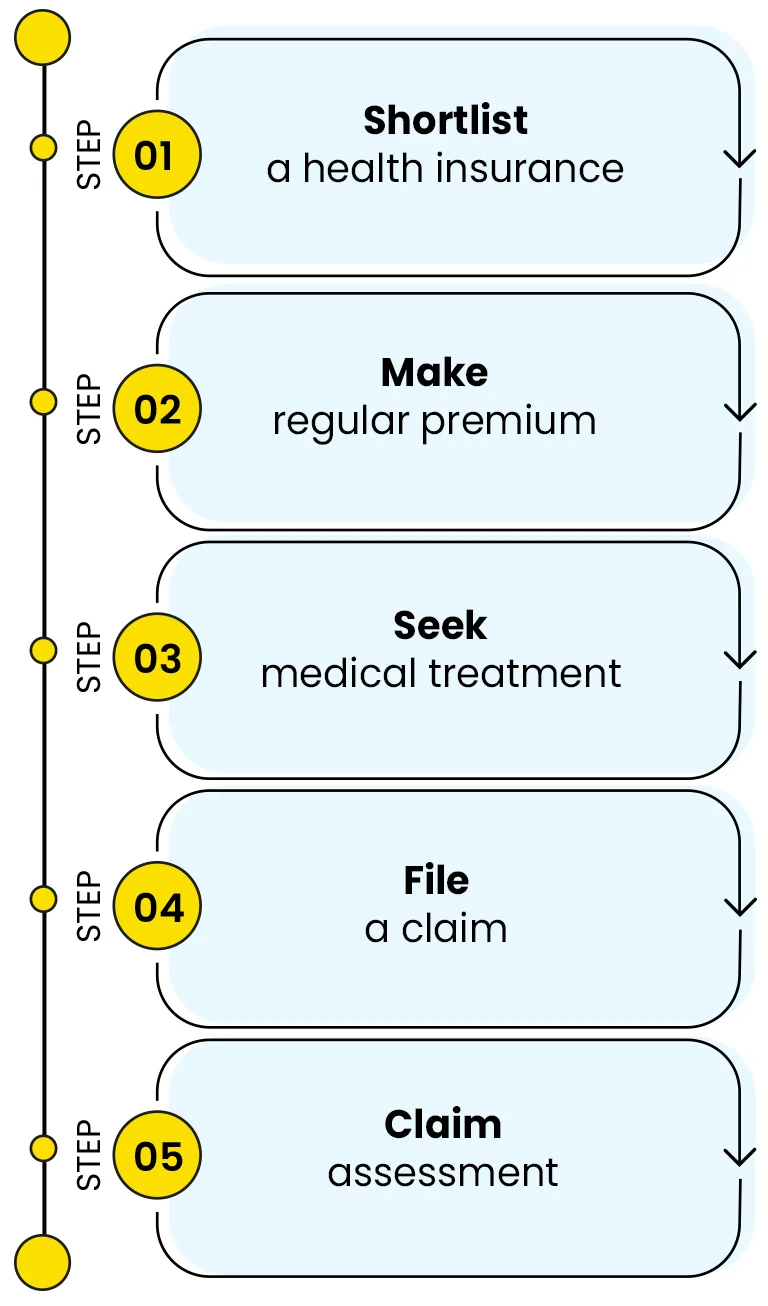

Let’s understand how health insurance works in five simple steps, explained with a case study:

Suvidha purchased a health insurance policy with a coverage of ₹10 Lakh for her family. A few months later, her mother fell ill and needed medical attention. As her condition worsened, she was admitted to a nearby network hospital.

Suvidha informed her insurer about the emergency hospitalisation and completed the required formalities. Since the hospital was within the insurer’s network, the treatment was covered under the cashless facility.

After discharge, the hospital directly settled the eligible bills with the insurer, and Suvidha paid only for the consumables items.

Later, she filed a reimbursement claim for the pre- and post-hospitalisation expenses. She submitted all necessary bills, reports, and the reimbursement form. The insurer verified the documents and credited the claim amount to her bank account.

Understand your policy better with a simple overview of inclusions, exclusions, and optional add-on benefits offered by our different health insurance plans:

Health insurance policies cover a wide range of medical expenses to provide strong financial protection during unexpected health emergencies. These plans go beyond basic hospital bills and include several healthcare benefits as per the policy terms and conditions. The expenses covered include:

Here are the standard exclusions every policyholder should be aware of:

Health insurance plans offer optional add-ons to customise your coverage and enhance your protection. Some of the common add-ons available across our plans include:

For health insurance in India, check policy-specific eligibility for conditions like co-payments and waiting periods. Below are Care Health Insurance's eligibility criteria:

| Minimum Entry Age | Individual- 5 years | Floater- 91 days with at least 1 insured person of age 18 years or above |

| Maximum Exit Age | Lifelong for Adults |

| Tenure Options | 1/2/3/4/5 Years |

| Cover Types | Individual and Family Floater basis |

| Waiting Period | 30 days for seasonal illnesses, except injury | 24 months for named ailments | 36 months for pre-existing diseases |

| Grace Period | 30 days to renew your policy post expiry |

Here’s a list of documents you'll need when buying health insurance online:

You can now calculate the premium using a simple digital calculator designed especially for medical insurance policies. This tool helps you get the right estimate of the amount of premium you will have to pay for your policy. It considers various factors to calculate the premium, including the information you have entered.To help you understand the benefits, a good health insurance plan in India is crucial for financial protection against rising medical costs. Here are the steps to calculate your premium:

Given below are some of the factors that affect the premium of your health insurance policy:

STEP 1

Emergency

Intimate within 24 hours of your hospitalization

Planned Hospitalization

Intimate us 48 hours prior to your hospitalization

STEP 2

Cashless

Request for pre-authorization

Reimbursement

Claim form submission

Complete the pre-authorization form available

at the hospitals' insurance/TPA Desk and send us through fax.

Approval

Approval letter sent by the claim management team

Query

Hospital/Insured to respond to the query raised by the claim management team

Rejected

You may initiate the treatment and file for reimbursement claim

Submission of claim form along with required

documents, as per the policy terms & conditions

Approval

Approval letter sent by the claim management team

Query

Insured to respond to the query raised by the claim management team

Rejected

We will communicate the reason in case of rejection

Given below are the set of documents that you will have to submit while making a claim:

| Category | Documents |

|---|---|

| Cashless Claim |

|

| Reimbursement Claim |

|

Dealing with a health insurance claim rejection can be really disappointing, especially when you're in the middle of a medical emergency. However, you should be aware that most rejections occur due to simple mistakes that can often be avoided. Let’s look at some common reasons why claims get rejected and how you can help prevent them.

Care Health Insurance strives to make quality health care accessible to everyone while maintaining a quick and hassle-free claim experience. Our Customer platform is an integrated app for all your health insurance needs. You can use this app for claim intimation, fill out a claim form online, upload the necessary claim documents, and track your claim status. Below is the step-by-step process to file claim intimation using ‘Claim Genie’

If you fall into the taxable slab, then your health insurance plan can fetch you tax benefits. Here’s how:

| Policyholders | Deductions for premium paid for self and family | Deductions for premium paid for parents | Preventive Health Check-Ups | Tax benefit |

|---|---|---|---|---|

| Self and covered members below 60 years | ₹25,000 | - | ₹5,000 | ₹25,000 |

| Self, covered members, and parents below 60 years | ₹25,000 | ₹25,000 | ₹5,000 | ₹50,000 |

| Self and covered members below 60 years, parents above 60 years | ₹25,000 | ₹50,000 | ₹5,000 | ₹75,000 |

Note: The tax benefits shown in the table apply under the Old Tax Regime, as per Section 80D. If you opt for the New Tax Regime, tax benefits may vary depending on applicable tax rules, changes, and policy terms and conditions.

Porting a medical plan is easy and can be done before the policy renewal stage. Just notify your existing insurer at least 45 days before the policy renewal date of your existing medical cover. Follow this simple step-by-step guide to port your existing health insurance policy and enjoy uninterrupted coverage with your new plan:

Step 1

On the home page, select the ‘Port Existing Policy’ option and follow the premium calculation journey.

Step 2

Fill up the proposal form and the portability form with relevant details and submit the required documents along with it.

Step 3

The requisite data will be furnished on the official portal of IRDAI.

Step 4

The new insurance company will underwrite the proposal and inform you within 15 days.

Now that you are versed in the details of health insurance, here are a few other things you should know to make an informed choice of a health insurance plan online. Click through to understand how to choose a health plan online:

Comparing premiums helps understand how various plans cost, their coverage, and their long-term benefits. Here are some tips to follow while comparing a health insurance plan:

To choose the best medical insurance in India, you must consider the following advantages:

The best part about the online availability of health covers is the secure payment gateways. With easy-to-follow steps and trusted payment partners, we offer a seamless online experience for buying the best health insurance plans in India. Our digital portal enables effortless premium payments through a secure digital payment gateway.

Here is a quick 6-step guide you should follow for making online insurance payments:

Every medical policy terminates upon the expiration of its policy term. That’s why renewing a mediclaim is crucial to ensure uninterrupted healthcare coverage and additional benefits such as a no-claim bonus and coverage for pre-existing ailments. The process of renewing a health insurance policy involves the following steps:

By purchasing a health policy online, you can renew your health plan digitally, thereby saving significant time and effort.

Health insurance is vital to financial planning, yet various misconceptions surround it. Let us examine the most common health insurance myths and facts behind these, to help you find the best health insurance in India.

Select from the following plans according to your location and health insurance needs:

Health Insurance Plans in Tamil Nadu

Starting @ ₹16/dayMedical insurance in Coimbatore

Starting @ ₹19/dayHealth insurance Plans in Kerala

Starting @ ₹19/dayHealth Insurance Plans In Chandigarh

Starting @ ₹19/dayMedical insurance Plans in Guwahati

Starting @ ₹19/dayMedical insurance Plans in Delhi

Starting @ ₹28/dayHealth insurance Plans in Bengaluru

Starting @ ₹19/dayCashless claim settlements are a cornerstone of the modern insurance landscape, offering numerous benefits to policyholders and the industry alike. Irdai in a master circular released on Wednesday alerted all insurance providers...

Visit to Discover MoreHealth insurance premiums are on their way up. A survey of 11,000 owners of personal health insurance policies by LocalCircles found that 52 per cent had witnessed an over 25 per cent increase in their renewal premiums in the past 12 months...

Visit to Discover MoreHealth Insurance for senior citizens: The recent amendments by the Insurance Regulatory and Development Authority of India (IRDAI) regarding health insurance rules are set to benefit senior citizens significantly...

Visit to Discover MoreAs we celebrate Mother’s Day, it is crucial to reflect on the health-related challenges that women face. From reproductive health to mental wellness, our mothers can encounter obstacles that demand attention, care and support...

Visit to Discover MoreCancer Coverage: Ever increasing number of cancer cases in India present a challenging aspect of the nation's healthcare landscape. According to the National Cancer Registry Programme, India recorded about 1.46 million new cases of cancer in 2022....

Visit to Discover MoreA growing number of health insurance customers are nowadays supplementing their base health insurance policies with riders. According to insurance aggregator Policybazaar.com, while only 15 per cent of customers purchased riders...

Visit to Discover MoreLook for hospitals around you

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services: 8860402452

Live Chat

Ultimate Care: UIN - CHIHLIP25044V012425

*Please read the policy T & C, brochure, and prospectus to know more about our medical plans cover as it may vary.

~Tax benefit is subject to changes in tax laws. Standard T&C Apply

**Number of Claims Settled as of Dec 2025

^10% discount is applicable for a 3-year policy

#Premium calculated for an individual (Age 18) for sum insured 5 Lakhs in Zone 2 cities with Care Supreme Policy.

##The premium is calculated for an insured individual (18) with a sum insured of 5 lakh in a Zone 3 city.

^^ Number of Cashless Healthcare Providers as of Dec 2025

1.Ultimate Care: The premium is calculated for an insured individual (18) with a sum insured of 5 lakhs in a Zone 3 city.

2.Care Supreme: The premium is calculated for an insured individual (18) with a sum insured of 5 Lakh in a Zone 3 city.

3.Care Advantage: The premium is calculated for an insured individual (18) with a sum insured of 1 crore in a Zone 3 city.

4.Care Supreme Senior: The premium is calculated for an insured individual (60+) with a sum insured of 5 lakhs in a Zone 3 city.