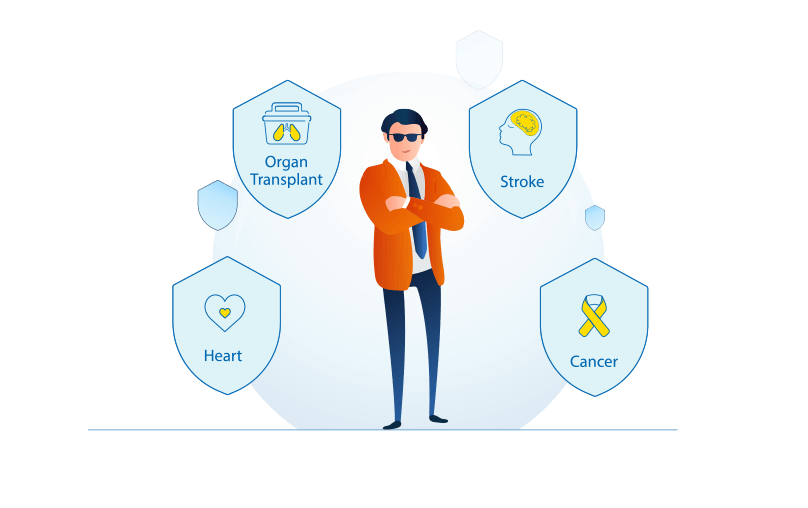

Zeroing in on a health insurance plan for your family is a tricky choice, given the number of insurers in the market who offer similar policies. It is not wise to simply choose the policy with the lowest amount of premium. You need to compare different policies, their features and benefits. Care Health Insurance (CHI) is a specialist Health Insurer and offers products keeping in mind the needs of a customer in the event of a medical exigency. CHI offers a distinct set of benefits giving a clear choice for providing you with the best possible health insurance.

![Awarded Awarded]()

Awarded as Best

Health Insurance Company of the year^

![claims-paid claims-paid]()

38 Lakh+ Claims Settled*

![cashless-claim cashless-claim]()

22900+

CASHLESS HEALTHCARE PROVIDERS^^

^India Insurance Summit & Awards 2023