Save tax up to ₹75,000~ u/s 80D

Senior Citizen Health Insurance is a specially designed health insurance plan for individuals typically aged 61 years and above, providing comprehensive coverage for medical needs in the golden years of life. Unlike regular health insurance, these plans cater to age-related health risks and pre-existing conditions, ensuring seniors receive timely and quality care without financial stress.

At Care Health Insurance, our Senior Citizen Health Insurance plans provide comprehensive coverage tailored to senior healthcare needs — including hospitalisation (IPD), Day Care procedures, pre- and post-hospitalisation expenses, annual health check-ups, AYUSH treatments, domiciliary care, ambulance services, and more. This enables senior citizens to focus on their health and well-being while staying protected from rising medical costs.

As people age, healthcare needs grow, and so do the expenses. This is where senior citizen health insurance plays a crucial role. Here are six incredible advantages that make this plan essential for elderly individuals:

Covers Pre-existing Illnesses

Various health plan for senior citizens offer reduced waiting periods, enabling quicker coverage for conditions like diabetes, hypertension, and cardiac issues.

Cashless Hospitalisation Across a Wide Network

Get hassle-free admission and treatment at a vast network of hospitals across India, without upfront payments.

Comprehensive In-patient and Daycare Coverage

Whether it’s a major surgery or a small daycare procedure, a comprehensive health insurance plan can cover medical expenses such as room rent, ICU charges, and doctor fees.

Domiciliary Treatment and AYUSH Coverage

Senior citizens can receive treatment from the comfort of their home when hospital transfer isn’t possible, or choose alternate therapy methods like Ayurveda and Homeopathy under AYUSH benefits.

Annual Health Check-ups

Stay up to date with your health with free preventive check-ups every year, a valuable feature for disease management and early detection.

A senior citizen health plan isn’t just about covering hospital bills, it’s about future planning, financial independence, and peace of mind. Here are some reasons to consider a medical insurance for senior citezens:

A health insurance for senior citizens is ideal for:

Even if you already have a health policy, a senior citizen health insurance offers additional focused protection and peace of mind.

Before you choose your coverage, it’s good to know what influences the premium of senior citizen health insurance India:

The older you are and the more complex your health history, the higher the risk for insurers, which directly affects the premium.

More coverage and more features like air ambulance, pharmacy benefits, or AYUSH cover will increase the premium, but also expand the scope of your protection.

Treatment costs vary across metros, semi-urban, and rural regions, and so does the premium. Living in a metro? Expect slightly higher costs compared to non-metros.

You can now calculate the premium using a simple health insurance premium calculator designed especially for medical insurance policies. Here are the detailed steps on how to calculate your premium:

Go to the Care Health Insurance homepage and navigate to products.

Select your desired policy and enter your mobile number in the 'Get Quote' section.

Provide details for insured members, including age and pin code, then click on the 'View Quote' button.

Customize your policy by adjusting the sum insured and add-ons.

Get your instant quote with applicable charges

Investing in suitable health coverage significantly enhances an elderly person's quality of life by easing the burden of hospitalization costs. Don't let these common myths deter you from securing a senior citizen mediclaim policy:

Myth 1: Too Old to Get Covered.

Reality: Individuals aged 61 and above are eligible for senior citizen medical coverage.

Myth 2: Pre-existing Illnesses Prevent Coverage.

Reality: Many seniors have existing medical conditions, but this does not disqualify them from purchasing a health insurance plan.

Myth 3: OPD Visits Are Not Covered.

Reality: Our senior citizen health insurance in India offers optional OPD care, covering reimbursement for bills ranging from Rs. 5,000 to Rs. 50,000 as per policy terms.

Myth 4: A Family Floater Plan Is Sufficient.

Reality: While parents can be included in a family floater, it's often insufficient. Given seniors' vulnerability to age-related illnesses and rising medical inflation, a shared sum insured may not provide adequate coverage.

Myth 5: Co-payment Charges Are a Burden.

Reality: With Care Health Insurance, senior citizens typically have a 20% co-payment. However, we strive to reduce this cost with the added benefit of a co-payment waiver.

Navigating the various senior citizen health insurance options can be challenging. To simplify your search for the ideal mediclaim policy, consider these key factors:

At Care Health Insurance, we meet the diverse healthcare needs of people in their old age. Here are some of our top-selling plans tailor-made for senior citizens:

Here's a detailed overview of the coverage offered by Care’s Senior Citizen Health Insurance plans:

| Plan Offering | Coverage Details |

|---|---|

| In-Patient Care | Up to SI |

| Day Care Treatment | All Day Care Procedures |

| Advance Technology Methods | Up to SI |

| Pre-Hospitalisation Cover | 60 days before hospitalisation |

| Post-Hospitalisation Cover | 180 days after discharge |

| AYUSH Treatment | Up to SI |

| Domiciliary Hospitalisation | Up to SI |

| Organ Donor Cover | Up to SI |

| Ambulance Cover | Up to Rs.10,000 per Year for SI < 15 Lacs & Up to SI for SI >= 15 Lacs |

| Cumulative Bonus | 50% of SI per year, max up to 100% of SI |

| Cumulative Bonus Super | Included for Eldest Member <= 45 years & >=76 yrs; Optional for Eldest Member > 46 years |

| Unlimited Automatic Recharge | ✅ |

| Unlimited E-Consultations | ✅ |

| Health Care Services | ✅ |

Medical expenditures are shooting high for elderly people across nations. Opting for medical policy for senior citizen is best to keep unbearable medical expenses at bay. Below is what we covered in it:

While Care Senior Health Insurance offers extensive protection, it’s important to understand the exclusions — or what's not covered under the policy. Here’s a quick overview:

Any medical expenses arising from self-harm, including suicide attempts or intentional injuries, are not covered.

Claims related to the consumption or abuse of alcohol, drugs, tobacco, or gutka are excluded from the policy.

Any treatment linked to pregnancy, childbirth, miscarriage, abortion, or related complications is not covered.

Expenses related to infertility evaluations, IVF, or any assisted reproduction techniques are excluded.

No coverage is provided for conditions resulting from war, riots, nuclear attacks, or civil unrest.

The policy doesn’t cover dental treatments or cosmetic surgeries unless they are required due to an accident.

Note: Always check the detailed policy brochure and terms & conditions to understand specific exclusions and limitations before buying.

At Care, availing of a mediclaim policy for senior citizens above 61 years comes with easy terms and eligibility conditions as mentioned below:

| Minimum Entry Age | 61 years |

| Maximum Entry Age | Lifelong, no bar |

| Renewability | Lifelong |

| Co-payment | Member above 61 years or above pay 20% co-payment per claim |

| Pre-existing Disease Waiting Period | 36 months of continued coverage |

| Named Ailment Waiting Period | 24 months of continued coverage |

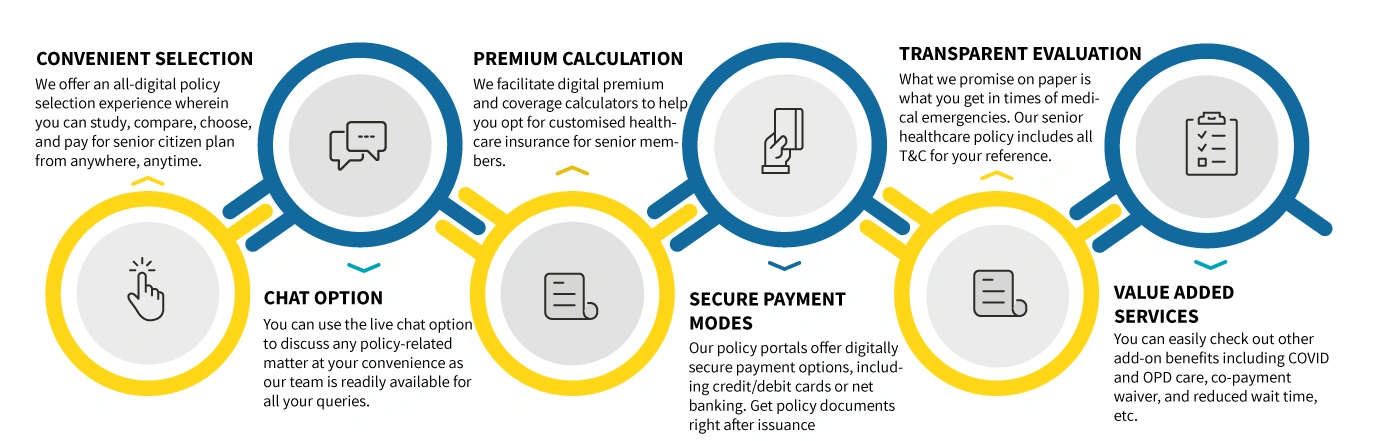

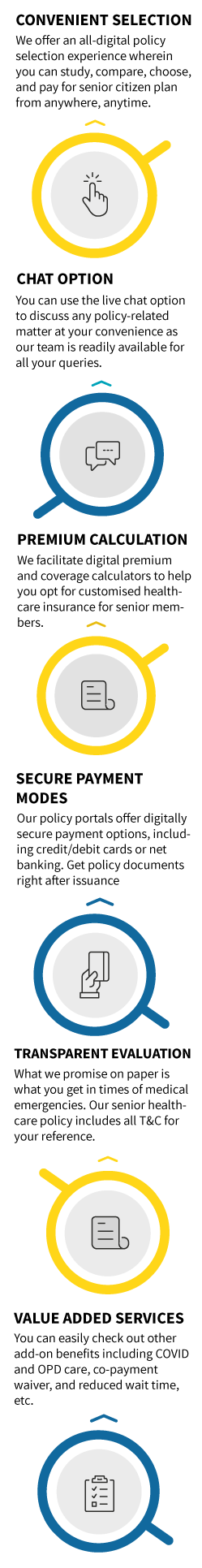

Experience a seamless and secure process when you choose to buy your senior citizen health insurance online with us.

STEP 1

Emergency

Intimate within 24 hours of your hospitalization

Planned Hospitalization

Intimate us 48 hours prior to your hospitalization

STEP 2

Cashless

Request for pre-authorization

Reimbursement

Claim form submission

Complete the pre-authorization form available

at the hospitals' insurance/TPA Desk and send us through fax.

Approval

Approval letter sent by the claim management team

Query

Hospital/Insured to respond to the query raised by the claim management team

Rejected

You may initiate the treatment and file for reimbursement claim

Submission of claim form along with required

documents, as per the policy terms & conditions

Approval

Approval letter sent by the claim management team

Query

Insured to respond to the query raised by the claim management team

Rejected

We will communicate the reason in case of rejection

To initiate your claim settlement, please submit the following original documents:

Look for hospitals around you

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services:

8860402452

Live Chat

Care Supreme: UIN - CHIHLIP25047V022425

Disclaimer : Information above is just for reference. Kindly read T & C of policy thoroughly, Do refer IRDAI guidelines for tax exemption conditions.

~Tax benefit is subject to changes in tax laws. Standard T&C Apply

~~Claim Settlement Ratio for the period April 2025 to Dec 2025

**Number of Claims Settled as of Dec 2025

^^Number of Cashless Healthcare Providers as of Dec 2025

*The premium is calculated for an insured individual (61) who opts for a sum insured of 5 lakh in a zone 3 city with add-ons that impact the premium reduction.