Save tax up to ₹75,000~ u/s 80D

Help

Save tax up to ₹75,000~ u/s 80D

Want to safeguard the health of your immediate and dependent family, including your spouse, children, and parents? Here’s a perfect choice: The policy covers your entire family’s medical needs with one comprehensive plan eliminating the struggle of maintaining several policies. With sum insured options up to ₹6 crores, the family plan offers the following features:

● A Single and Affordable Premium PayoutFamily Floater Insurance Policy

Young adults aged 35 years and below need a complete package of healthcare and financial security. To meet this need, you should choose our inflation-proof insurance: The policy comes with all-inclusive healthcare benefits that help keep young adults safe against medical crises. With a no co-payment clause and personal accident coverage, this health insurance policy offers the following benefits to early birds:

● Available on Individual and Family Floater BasisYouth Health Insurance Plan

Your parents and elders need special care when they turn 60 and above. If you are looking for adequate coverage for your elders to enjoy a stress-free and financially secured retirement, here’s your go-to choice: The senior citizen health cover supports older people in paying hefty medical expenses due to old age-related ailments. Available to both individual and floater basis, the policy holds the following unique features:

● No Pre-policy Medical Check-ups*Senior Citizen Health Insurance Plan

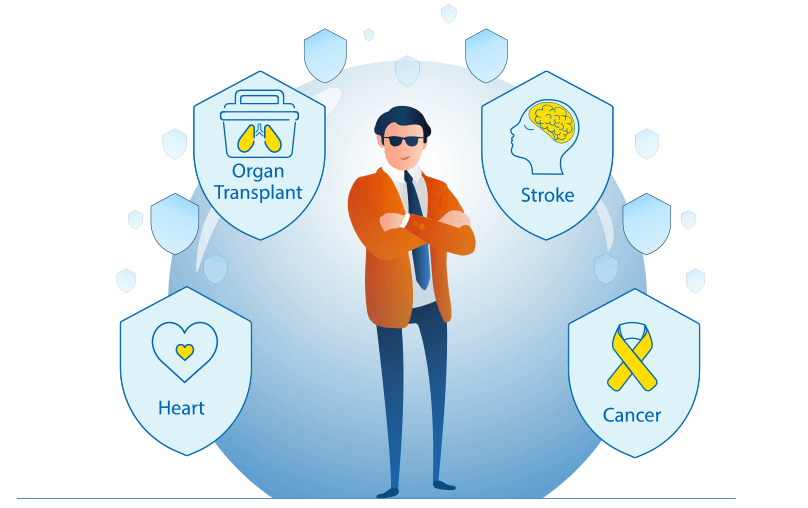

The treatment of cancer, lung disease, and other critical ailments can completely wash away your savings. So, if you are anticipating any chronic conditions among your family, do check our: The policy offers a shield against the medical treatment expenses of 32 critical ailments, like stroke, paralysis, organ transplant, etc. with the following benefits:

● Mediclaim Policy with Low Premium & Optimum CoverageCritical Illness Insurance

| Cashless Claim Process | Reimbursement Claim Process |

|---|---|

| Step 1: Fill out the pre-authorization form available at the insurance desk and send it to our claim management team. | Step 1: Submit your claim form along with the required documents. |

| Step 2: You will get an approval letter once your claim is verified. | Step 2: Get the approval letter from the claim management team. |

| Step 3: Make sure to respond to queries from the claim management team. | Step 3: Respond to queries raised by our claim management team. |

| Step 4: File a reimbursement claim request in case your cashless claim request doesn't go through. | Step 4: In case your claim is rejected, our claims team will contact you and share the reasons of rejection at the earliest. |

Insurance for medical expenses provides you with comprehensive financial protection in the time of urgent need by covering various medical expenses apart from the bills you incur during hospitalisation. The coverage provided is subject to the policy terms and conditions. The expenses covered in in health insurance policies are:

STEP 1

Emergency

Intimate within 24 hours of your hospitalization

Planned Hospitalization

Intimate us 48 hours prior to your hospitalization

STEP 2

Cashless

Request for pre-authorization

Reimbursement

Claim form submission

Complete the pre-authorization form available

at the hospitals' insurance/TPA Desk and send us through fax.

Approval

Approval letter sent by the claim management team

Query

Hospital/Insured to respond to the query raised by the claim management team

Rejected

You may initiate the treatment and file for reimbursement claim

Submission of claim form along with required

documents, as per the policy terms & conditions

Approval

Approval letter sent by the claim management team

Query

Insured to respond to the query raised by the claim management team

Rejected

We will communicate the reason in case of rejection

Here is a step-by-step guide to port your health insurance scheme and get covered under Care Health Insurance plans:

Step 1

On the home page of Care Health select the “port existing policy” option and follow the premium calculation journey.

Step 2

Fill up the proposal form and the portability form with relevant details and submit the required documents along with it.

Step 3

The requisite data will be furnished on the official portal of IRDAI.

Step 4

The new insurance company will underwrite the proposal and inform you within 15 days.

Our mediclaim for senior citizens benefits elderly people by taking care of all their old-age health worries and gifting them the joy of life. Our medical policy for senior citizens provides vast coverage across network hospitals, treatments, OPD, and COVID centers for helping elder ones lead tension-free retirement years.

Increased health risks brought on by age and changing healthcare needs undeniably highlight the importance of having a senior citizen health insurance scheme.

Affordable Premium

You can rest assured that it is easy to get health coverage for senior citizens at an affordable premium and maximum coverage.

Easy EMI for Premium

Get your health cover today without worrying about current finances through our easy EMI options.

Discounts & Offers

We understand how important our finances post-retirement is, so here we come with numerous discounts such as a multi-year policy, Smart Select, and many more.

Second Opinion

Not sure about your current treatment procedures? Worry not! We get you covered to avail a second opinion from other doctors for a specified illness.

Organ Donor Cover

We respect and encourage the noble cause of donating organs. Our senior citizen insurance covers expenses for organ harvesting operations.

At Care Health Insurance, we aim to serve customers beyond basic health insurance services. We offer enhanced medical insurance policies with valuable features to meet the diverse medical needs of people across the country.

At our core, we're not just about health insurance; we're dedicated to exceeding expectations and making the best possible healthcare facilities within everyone’s reach.

Care health insurance plans offer a diverse range of sum insured, starting from ₹3 lakhs to ₹6 crores, enhanced with various healthcare benefits like COVID and OPD care, cashless hospitalisation, day-care treatment, and annual health check-ups, among others. It's a spectrum of possibilities tailored to meet your unique healthcare needs.

At Care Insurance, we strive to provide our customers with the best health plans with wider coverage. Along with in-patient expenses, pre and post-hospitalisation, domiciliary hospitalisation, and organ donation, we also cover AYUSH treatment and modern technology treatments to ensure our customers choose the medical treatments of their choice through our long list of health insurance policies in India.

Take a look at the features of our comprehensive health insurance plans that make us one of the best health insurance companies in India.

Get the best financial security with Care Health Insurance!

Sales:1800-102-4499

Services: 8860402452

Live Chat