Subscribe to get weekly insights

Always stay up to date with our newest articles sent direct to your inbox

Published on 23 Jan, 2026

favorite0Like

favoriteBe the First to Like

24 Views

3 min Read

Let’s talk about something many of us feel but rarely say out loud. That uneasy feeling when you see your bank balance dip.

The random thoughts that hover, if you wake up at 2 a.m., about bills or EMIs or something that could go wrong with your finances. The guilt after spending on yourself, even when it’s not an impulsive action.

That’s money anxiety. If you suspect that you’re not alone, you’re right! It’s a very human response to financial uncertainty.

Money anxiety is far more common than we admit, and it doesn’t just affect your financial life. It can quietly take over your mind, your body and your sense of peace.

Money anxiety is the persistent stress or fear around finances, even when things aren’t objectively “bad”. It can show up even if you’re earning ‘enough’.

This experience can be triggered by unstable income, rising living costs, debt or even social media comparison culture. For many young adults today, the pressure to ‘have it all figured out’ while managing real-world financial responsibilities only amplifies the stress.

What’s important to understand is that money anxiety doesn’t stay confined to spread-sheets and bank apps. It seeps into your mind and body.

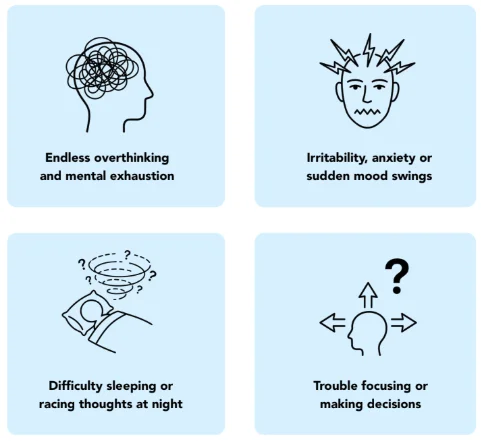

When money is a constant worry, your brain never truly switches off.

You may notice:

Over time, this mental load chips away at confidence. You start doubting yourself, delaying decisions related to money and that only makes the stress amplify.

____________________________________________________________________________

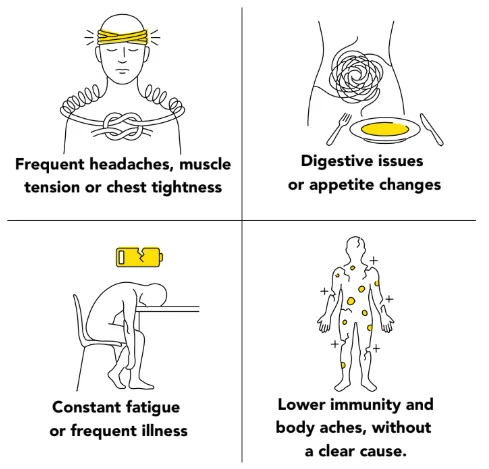

Your body treats financial stress like a threat.

When money anxiety becomes chronic, stress hormones like cortisol stay elevated. This can lead to:

Long-term financial stress has even been linked to high blood pressure and heart-related concerns. In other words, money stress isn’t ‘just in your head’; your body feels it too.

Here’s where things get tricky.

Stress leads to avoidance—ignoring bank statements, delaying bills or skipping financial planning altogether. Or it leads to emotional spending as a temporary escape. Both responses bring short-term relief… followed by more stress.

And just like that, the cycle continues.

But this cycle isn’t a lack of discipline — it’s a stress response.

And it can be broken.

____________________________________________________________________________

Becoming perfect with money is not the answer. All you have to do is incorporate safety, clarity and compassion in your approach to money.

1. Start with your mindset: Change how you talk to yourself about money. Your net worth shouldn’t be your self-worth. Spending mindfully is healthier than extreme restriction, followed by guilt. Managing money is a skill, not a character trait.

2. Build clarity, not control: The first step is naming what scares you; this could be uncertainty, medical expenses, job stability and/or debt. Clarity reduces anxiety. You don’t need a complicated budget. Start by simply knowing what comes in and what goes out.

3. Create small safety nets: An emergency fund, even a small one, signals safety to your sub-conscious. So does having basic health and financial protection in place. These aren’t ‘extras’; they’re foundations.

You don’t need a perfect budget or financial plan that intimidates you. Start small, with little steps that make you feel like you are getting somewhere. For instance:

Progress beats perfection every single time.

____________________________________________________________________________

One of the most significant reasons behind money anxiety is uncertainty, especially around emergencies.

And did you know? To keep a check on just that, Care Health Insurance has recently introduced an Unlimited Sum Insured option under its Ultimate Care Health Insurance Plan.

Additionally, the plan’s two-hour hospitalisation feature ensures that even trivial hospitalisations are covered under a financial safety net and you can be rest assured.

After all, peace of mind is a form of wealth, too!

If money anxiety is affecting your sleep, relationships, or health, consider seeking support. Financial advisors, therapists, or even honest conversations with trusted people can break isolation and put things in perspective.

You don’t have to carry this alone.

You’re not failing at money management. You’re navigating a complex world with rising costs, endless pressure and very real responsibilities.

A healthy financial life isn’t about waking up rich one day. It’s about fewer knots in your stomach, fewer late-night worries, and more moments where you feel in control and happy with your progress instead of overwhelmed.

With small, consistent steps that peace is absolutely within reach. So, start small. And be kind to yourself.

Remember - while taking care of your money is important, taking care of your mind and body are important too; they are the most basic form of wealth.

For more such insightful information, stay tuned!

favoriteBe the First to Like

Always stay up to date with our newest articles sent direct to your inbox

Loading...