Subscribe to get weekly insights

Always stay up to date with our newest articles sent direct to your inbox

Published on 6 Oct, 2025

favorite1Like

49 Views

3 min Read

Imagine this: it’s the year 2055. You’re 60, relaxed, sipping tea in your garden, planning your next trip to Europe. No stress about bills, no second-guessing your financial security. Why? All because in your 20s, you had the foresight to start investing.

Sounds like a dream? It doesn’t have to be.

Your 20s are more than just a time to find your career footing or build lifestyle habits—they’re a golden window for wealth creation. When you start investing early you give your money the most important tool that it needs to grow: time. And when time teams up with discipline, the result is nothing short of magic.

When you invest, your money earns returns. Over time, those returns also start earning returns. That’s called compounding—and it works best when you give it time.

Think of investing like rolling a snowball down a snowy hill. In the beginning, it’s small. But the further it rolls, the larger and faster it grows.

Here’s a simple numerical that brings this out:

That’s a difference of over ₹2 crore—a considerable reward, just for starting early.

Let’s meet Aarti and Rohan.

At age 60:

That’s the power of compounding—and why time matters more than the amount.

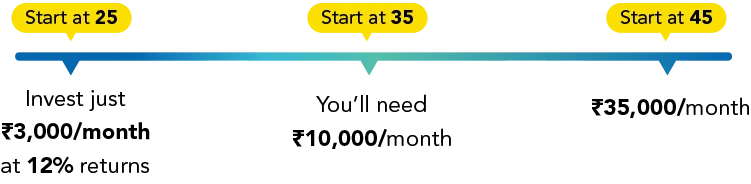

Delaying your investment journey comes at a cost—to reach the same retirement corpus, the amount you need to invest per month increases sharply with each year you wait.

Let’s say you want to retire with ₹2 crore, here are some scenarios:

The longer you wait, the heavier the lift becomes. And don’t forget inflation—what looks like ₹2 crore today may only feel like ₹50 lakh 30 years later.

Wondering where to start your journey to creating a comfortable retirement corpus? SIPs or Systematic Investment Plans are a great vehicle for this purpose.

A SIP is a simple, automated way to invest a fixed amount every month into a mutual fund of your choice. It’s beginner-friendly, requires no lump sum, and runs quietly in the background; it’s like putting your savings and investment routine on autopilot.

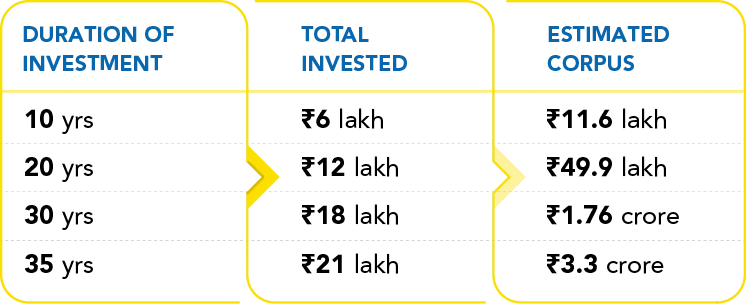

Here’s how a ₹5,000 SIP grows over time at 12% annual returns:

While SIPs are a good starting point, your investment toolbox could include:

Also remember: insurance is not an investment—but it protects everything you’re building. Health insurance, like the kind offered by Care Insurance, shields your finances from unexpected shocks, so your investments can grow uninterrupted.

If we have to summarize the messages from all the numerical illustrations shared so far, these six lessons stand out:

1. Power of Compounding: The earlier you start to invest, the more time your money gets to grow. Even small amounts can turn into big wealth over time.

2. Builds Financial Discipline: Starting early helps you build a habit of saving and managing money better - a skill that pays off lifelong.

3. Takes Advantage of Risk: In the younger stages of life, your risk-taking tendency is higher, which often gives better returns in the long run.

4. More Time to Learn & Recover: Early starters get time to learn from mistakes and recover from market ups and downs without having to panic about family stability.

5. Achieve Goals Faster: Whether it’s buying a car, house, or retiring early, starting sooner brings you closer to your goals, faster.

6. Less Pressure Later: If you begin early, you don’t need to invest huge amounts later. Small, consistent investing starting today can reduce stress later.

The journey to financial freedom doesn’t begin with a windfall—it begins with a decision. The decision to start early, stay steady and let time work its magic.

And as you build your wealth, remember to protect it too. Health setbacks, unexpected emergencies, and hospital bills can derail even the best-laid plans. Pairing your investments with comprehensive health coverage from Care Insurance ensures you’re covered from all angles—today and tomorrow.

So, the next time you think ₹5000 is too small to matter, remember this: your 60-year- old self is counting on you and will be really glad you didn’t put off investing any longer.

Liked what you read? Stay tuned to receive more such insightful articles directly in your mailbox!

Till then, share this article with the people you care about.

Stay informed, stay insured.

Team Care Health

Always stay up to date with our newest articles sent direct to your inbox

Loading...