Managing your Care Health Insurance policy is now App Solutely Simple with our all new mobile app. Available on both Google Play Store & iOS. To download

Time remaining to save tax

Health insurance can help you save tax under section 80D

IT'LL ONLY TAKE A FEW SECONDS

TO TAKE A RESPONSIBLE

DECISION FOR

YOU AND YOUR FAMILY

Smart Select you will get 15% discount on

Premium. See the Smart Select

Hospital Network in your city.

Life is about experiencing every good bit of it throughout one's lifetime; be it a walk in the park with your parents or building memories of playing with your little one. At Care Health Insurance , we understand that these experiences can be truly rejoiced when one lives a healthy life without having to worry about any unforeseen medical issues.

In line with our objective of ensuring good health...hamesha! Our Family Health Insurance Plan – 'Care'; helps safeguard you and your family against financial risks arising out of a medical emergency. With 'Care' by your side, you can be assured that while you're unwell; we'll take up all the hassles related to your treatment so that you can stay worry-free and focus only on your recovery.

A comprehensive family health insurance plan to meet everyone's healthcare needs.

We understand that the meter doesn't start from hospitalization but from the time of diagnosis and goes on even post discharge. We stand with you throughout the journey and not just for an event.

The procedures that you undergo before getting hospitalized finally lead you to a hospital, such as investigative tests and routine medication, can be quite financially draining. We cover the medical expenses incurred by you up to 30 days before your hospitalization.

It's our utmost concern that you get the medical attention, you require as soon as possible, especially in an emergency. Which is why, we reimburse expenses incurred by you while availing a domestic road ambulance during your hospitalization. Not just this, some plans of our product care also offers coverage for availing an Air Ambulance if suggested by a doctor.

We pay for – room charges, nursing expenses and intensive care unit charges, surgeon's fee, doctor's fee, anesthesia, blood, oxygen, operation theater charges, etc.; If you are admitted to a hospital for in-patient care, for a minimum period of 24 consecutive hours.

We cover medical expenses if you undergo a day care treatment which might not require you to stay hospitalized for 24 hours or more. As a matter of fact we cover over 540+ day care procedures.

We reimburse every expense occurred while you're staying in single or private room. You can also upgrade your room should there be a need to and is recommended by a treating doctor.

In time of an emergency we believe your focus should be only on your recovery. Hence we take care of those ICU charges that come in your way of getting a quality treatment.

Expenses don't end once you're discharged which is why even we don't rest unless you're completely ready to take all the challenges of life head on. We reimburse expenses such as doctor consultations,Diagnostic tests, medications etc that you incur up to 60 days post your hospitalization.

In case of an emergency or a medical condition that does not allow you to get admitted in a hospital, we provide coverage for medical expenses incurred during your treatment at home for a period exceeding 3 consecutive days. So nothing should delay the treatment you deserve.

We believe in the old adage that an ounce of prevention is better than a pound of cure. This is why we give an Annual Health Check-up for yourself and all members covered by your policy, including children.

Keep your worries regarding medical expenses outside the door with Automatic Recharge of Sum insured. If you ever run out of your health cover due to claims made, we will reinstate the entire Sum Insured amount of your policy. This additional amount can be used by you for any other ailment or by any other insured member for treatment of any ailment.

We raise a cheer to good health for every year that you don't claim by increasing your Sum Insured by 10%, up to a maximum of 50% in consecutive 5 years.

We care about those who help you as much as we care for you. So, beyond ensuring that your medical needs are met, we will reimburse you for medical expenses that are incurred by an organ donor while undergoing the organ transplant surgery.

Sometimes reassurance works better than the cure itself. Which is why if, at any moment you feel uncertain about your diagnosis, you can opt for a second opinion at no extra cost specially arranged by us.

All our plans including 'care', come with no upper age limit of enrollment i.e. even if a person is 100 years old, they can definitely apply.

We don't leave you in between the journey and honor our commitment by giving our customers option of lifelong renewability i.e. once enrolled an individual can continue to stay covered throughout one's life, provided they renew their policy on time every year.

We understand that sometimes non-allopathic treatments may prove to be more effective. Whether it is Ayurveda, Unani, Sidha or Homeopathy, choose the treatment that suits you and we will cover it up to a specified limit and varies according to the plan chosen.

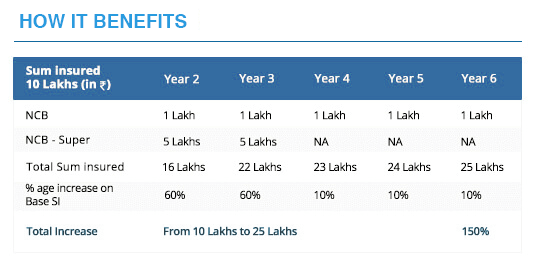

By choosing an optional cover – NCB Super – you can further increase your sum insured amount by 50% for every claim free year up to a maximum of 100%. Hence – in total with both NCB & NCB Super one can increase their sum insured up to 150% in 5 years. Help me understand working of NCB & NCB – Super!

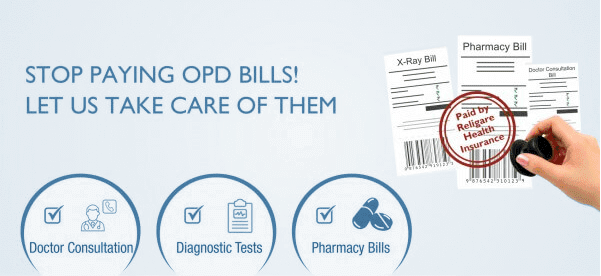

Your family may avoid hospitalization for many years at a stretch. However, you have to be really fortunate to avoid doctor consultation for even a few months. For all the visits for all routine visits to the hospital - we give you 1% of your Sum Insured for doctor consultation & diagnostic tests each. This can be availed via a cashless health card and additional premium paid to avail this add- on cover is also applicable for tax benefit under section 80D of IT act.

There should never be a time when you run out of coverage, which is why by selecting this add – on cover your sum insured amount if re-instated in your policy every time your sum insured exhausts. And this can be availed unlimited number of times.

The right cure may be miles away but never out of your reach with Air Ambulance Cover. For all those times when you might be recommended a treatment which is not in your city of stay.

Forget the hassles of maintaining two separate policies, one for a health insurance cover & second for personal accident cover. By selecting this add- on cover you get coverage for Accidental Death and Permanent Total Disability for up to 10 times of the Sum Insured opted.

We believe that sometimes reassurance works better than the cure itself. Hence before going ahead with the treatment recommended, we give you an option to consult doctors and take a second opinion.

Quality Healthcare cannot have boundaries. So if you ever feel the need get treated at an overseas facility, rest assured, since with this add-on cover you get Global Coverage that too on a cashless basis across listed network hospitals.

Care 4 (5,7,10 Lakh)

Care 5 (15,20,25,30,40 Lakh)

Care 6 (50,60,75 Lakh)

Care 7 (1,2,3,6 Cr)

| Features/ Plan (SI) | Care 4 (5,7,10 Lakh) Elite |

Care 5 (15,20,25,30,40 Lakh) Elite Plus |

|---|---|---|

| In patient hospitalization | Upto Sum Insured | Upto Sum Insured |

| Pre-hospitalization | 30 days | 30 days |

| Post-hospitalization | 60 days | 60 days |

| Day Care Treatments | Yes | Yes |

| Room Rent | Single Private Room | Single Private Room (upgradable to next level) |

| ICU charges | No Limit | No Limit |

| Ambulance Cover | Rs.2,000/ hospitalization | Rs.2,500/ hospitalization |

| Domicilliary hospitalization | Upto 10% of SI | Upto 10% of SI |

| Health Check-up | Yes, all members | Yes, all members |

| Recharge of SI | Yes | Yes |

| No Claim Bonus | Yes | Yes |

| Organ Donor Cover | Rs.100,000 | Rs.200,000 |

| Second opinion | Yes | Yes |

| Alternative Treatments | Upto Rs.20,000 | Upto Rs.30,000 |

| Features/ Plan (SI) | Care 5 (15,20,25,30,40 Lakh) Elite Plus |

Care 6 (50,60,75 Lakh) Global |

|---|---|---|

| In patient hospitalization | Upto Sum Insured | Upto Sum Insured |

| Pre-hospitalization | 30 days | 30 days |

| Post-hospitalization | 60 days | 60 days |

| Day Care Treatments | Yes | Yes |

| Room Rent | Single Private Room (upgradable to next level) |

Single Private Room (upgradable to next level) |

| ICU charges | No Limit | No Limit |

| Ambulance Cover | Rs.2,500/ hospitalization | Rs.3,000/ hospitalization |

| Domicilliary hospitalization | Upto 10% of SI | Upto 10% of SI |

| Health Check-up | Yes, all members | Yes, all members |

| Recharge of SI | Yes | Yes |

| No Claim Bonus | Yes | Yes |

| Organ Donor Cover | Rs.200,000 | Rs.300,000 |

| Second opinion | Yes | Yes |

| Alternative Treatments | Upto Rs.30,000 | Upto Rs.40,000 |

| Care Anywhere | - | Yes |

| Maternity Cover | - | Upto 100,000 |

| Features/ Plan (SI) | Care 6 (50,60,75 Lakh) Global |

Care 7 (1,2,3,6 Cr) Global Plus |

|---|---|---|

| In patient hospitalization | Upto SI | Upto SI |

| Pre-hospitalization | Upto SI ,30 days | Upto SI , 30 days |

| Post-hospitalization | Upto SI ,60 days | Upto SI , 60 days |

| Day Care Treatments | Upto SI | Upto SI |

| Room Rent | Single Private Room (upgradable to next level) |

Single Private Room (upgradable to next level) |

| ICU charges | No Limit | |

| Ambulance Cover | Rs.3,000/ hospitalization | Rs.3,000/ hospitalization |

| Domicilliary hospitalization | Upto 10% of SI | Upto 10% of SI |

| Health Check-up | Yes, all members | Yes, all members |

| Recharge of SI | Yes, Up to SI (Once in a Policy Year) | Yes, Up to SI (Once in a Policy Year) |

| No Claim Bonus | Yes | Yes |

| Organ Donor Cover | Rs.300,000 | Rs.500,000 |

| Second opinion | Yes | Yes |

| Alternative Treatments | Upto Rs.40,000 | Upto Rs.50,000 |

| Care Anywhere | Yes | Yes |

| Maternity Cover | Upto 100,000 | Upto 200,000 |

| Vaccination Cover | Yes, Upto Rs. 10,000 | |

| Global Coverage: (excluding USA) Coverage outside India & USA - 45 continuous days in a single trip; Max. 90 days on a cumulative basis, in a Policy Year | Up to SI for Hospitalization Expenses & up to the limit specified under `Maternity Cover` towards Maternity expenses; With a 10% co-payment per Claim | |

| Special Add on cover: | ||

| Global Coverage - Total Geographical scope of Benefit `Global Coverage (excluding USA)` is extended to USA also | Up to SI for Hospitalization Expenses & up to the limit specified under `Maternity Cover` towards Maternity expenses; With a 10% co-payment per Claim |

| Policy Terms | |

| Minimum entry age | 91 days |

| Maximum age | No age bar |

| Renewal | Lifelong Renewability. The Policy can be renewed under the then prevailing Health Insurance Product or its nearest substitute approved by IRDA. |

| Renewal premium | Premium payable on renewal and on subsequent continuation of cover arc subject to change with prior approval from IRDA. |

| Co-payment | No Co-payment in policy, if age of the eldest member insured with us at the time of first policy is below 61 years. 20% Co-payment will be applicable in policy, if age of the eldest member insured with us at the time of first policy is 61 years or above 61 years i.e. you will have to pay 20% of the claim amount under the policy, if any. We pay the rest. |

| Waiting period | 30 days for any illness except injury |

| Waiting period for pre-existing illnesses | Four years of continuous coverage |

| Change in sum insured | You can enhance your sum insured under the policy only upon renewal |

| Grace period | 30 days from the date of expiry to renew the policy |

+

Vast & growing hospital network for cashless claims

Lakh +

Count of Claim Settled^

In-house settlement for better management

Delivering Industry best settlement Ratio^

Less Grievance Ratio per 10,000 claims

Process for Hospitalization

Process for Everyday Care

Claims Procedure

Yes, cashless facility is available

You can buy health insurance through digital direct to consumer, banks, NBFCs, individual agents, brokers, web aggregators, corporate agents and rural banking

you can cover Self, Spouse, dependent children and parents.

Health insurance is necessary owing to increasing medical costs these days & uncertain environment. Therefore, insuring your family against Health Insurance is a must & should surely be a part of your regular financial planning.

a family floater health insurance, as the name suggests is a plan that is made for families. Family floater health insurance plans usually covers the individual, spouse and children or Parents. In general the cost of buying floater coverage for the family is less than buying the Individual policies for each member. However in a Floater Policy the Sum Insured is shared by all members and in Individual policy each member has a separate Sum Insure

The individual or family floater health insurance works on the principle of indemnity. This means that these insurance policies will pay you only what you have spent for medical treatment in hospital. On the other hand, the critical illness or the hospital cash insurance pays you the amount insured, irrespective of the amount spent for medical treatment. These are a benefit based policies.

Insurance is a contract of utmost good faith. It always pays to be honest. Declaring the correct and accurate health status at the time of buying health insurance ensures smooth processing of your application. This will also help us service you in a better manner.

Buying an individual cover or a floater cover is an individual’s perception. However, as a general rule, at younger ages floater cover is advisable. As you grow older, you should go for an individual cover.

For instance a person wants a health insurance for himself, his spouse & their children, the Family Floater plan offers insurance coverage to the entire family under one premium payment. Let’s take an example wherein the person insures himself, his spouse & the dependent children with the individual insurance plans with a sum insured of Rs. 1 lakh each, he ends up paying premium ranging between Rs. 1000 - Rs. 2000 for each family member. On the other hand if the person would have opted for the family floater plan with the sum insured of Rs. 3 lakhs, the total premium would surely be less than the separate premium payments in individual health insurance plans. Moreover the separate health plan holds the cover of only Rs. 1 lakh as against Rs. 3 lakh in case of the Floater plan thus helping the family in case the medical treatment costs go beyond that. This Rs. 3 Lac is available for each of the family members individually as well as collectively.

This concept works on the same lines as the no-claim bonus on your car insurance. A Policyholder, who hasn’t made any claim in a year, can use the bonus to their benefit the following year.

Similarly, CARE offers a 10% increase in the policy sum insured for every claim-free year, with no change in premium. So, a policy with a sum insured of Rs 5 lakh, will get an extended cover of Rs 50,000 the following year at the same premium. A claim-free third year will see him earning another ten per cent extra cover on his base sum insured, taking the total to Rs 6 lakh. A maximum bonus of up to 50 per cent is permissible.

In case of claim, the accumulated bonus is reduced by 10%.

We will automatically recharge the sum insured, in case the sum insured and any no claim bonus accumulated is exhausted during the policy year. The sum insured will be recharged once in a policy year. Recharge Sum Insured can be used for future claims and not against an illness/disease (including its complications) for which a claim has already been made in the current policy year.

You may be required to undergo a medical check-up after you buy, incase any member to be insured is above 45 age or for sum insured Rs. 15 Lakhs or above. In most of the cases, the medical tests are done in your home, after taking appointment from you. No payment is required upfront for the same. Incase the policy is issued, you will not be charged anything. However, if the policy is declined/Canceled, medical charges will be deducted from the refundable premium amount. This will enable us a better understanding of your current and future health requirements. For further details, please refer to the prospectus or call 1800-102-4488 (Toll free).

We offer a free look period to review your policy terms and conditions. In case you are not satisfied with these, you can request for cancellation of your policy during this period. You will be charged the pro-rated premium for the period during which your policy was in-force, the cost of pre-policy health check-up, if any, and the stamp duty. The balance premium would be refunded.

Also, you can request for cancellation of your policy at any time during the policy period. You will be refunded the premium amount as per the short scale grid. The grid is available in your Policy Terms and Conditions. However, in case you have reported any claim with us, you will not be entitled to any refund of premium on cancellation of the policy.

Health Insurance companies use Co-Payment after insured member turns a certain age. Co-pay is that part of your claim amount, which you have to bear. Co-pay can be in % terms or an absolute amount. For example, in case of co-pay of 20% and claim of Rs. 10,000, we will pay you Rs. 8,000 (80% of 10K) and you will bear 20% (Rs. 2,000). In Religare Health Insurance policy there is No Co-payment ever, if insured with us before age of 61.

You can apply for CARE under portability with following documents:

At CHI, we endeavour to financially safeguard your family by offering comprehensive health insurance plans that are specifically designed to offer coverage for various medical expenses at the best premium. We are committed to delivering impeccable services by providing specific travel insurance while guaranteeing the benefits of hassle-free claims procedures.

^Claim settlement ratio is for FY 19-20 and ^number of claims settled as on February, 2022

WhatsApp Chat Support: 8860402452

Disclaimer: For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

UIN: IRDAI/HLT/RHI/P-H/V.II/253/16-17. UAN2: 19032845.

Get the best financial security with Care Health Insurance!