Frequently asked questions

Why Care Health Insurance?

Care Health Insurance is one of India's leading Health Insurance providers, with 58 Lakh+ insurance claims settled since inception. Care Health Insurance provides comprehensive health insurance benefits, including in-patient hospitalisation, pre and post-hospitalisation medical expenses, access to advanced medical treatments, daily allowances during hospitalisation and cover for AYUSH treatments.

How are Care's Products different from those of its Competitors?

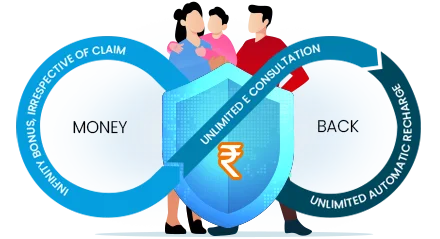

Choosing Care means choosing a health insurance plan that rewards you for staying healthy. Ultimate Care’s unique premium payback benefit gives you a refund of the first year’s premium for five consecutive claim-free years. Further, the loyalty benefit doubles your base sum insured and waives the waiting period for this additional amount.

What are Care’s recognitions?

Care Health Insurance is India's second-largest standalone health insurance provider. The company received the "Editor's Choice Award for Best Product Innovation" at Finnoviti and the "Best Medical Insurance Product Award" at The FICCI Healthcare Awards for its exceptional services. At the ABP News-BFSI Awards and the Insurance India Summit & Awards, Care was also recognised as the "Best Health Insurance Company" and the "Best Claims Service Leader of the Year."

Where can you get cashless claims service with us?

Care Health Insurance offers its customers cashless claims services at over 21700 cashless healthcare providers. The policyholder doesn't have to bear any expenses as we directly pay the amount to your cashless healthcare provider. You can simply go to our network locator page from the contact us menu and enter your state and city to find the nearest cashless healthcare provider around you.

What is the turnaround time for claim settlement at Care Health Insurance?

Company shall comply to mandated claim settlement turnaround time of 1 hour for Cashless Preauthorisation, 3 hours for Cashless Discharge request processing & 15 days for settlement of Reimbursement claim from the time of provision of all requirements of claim.

How many lives have we touched with our coverage?

Care has covered 9 Crores+ lives with its wide range of healthcare products that covers you for any medical emergencies. This makes us a reliable and trusted healthcare provider where you can customize your coverage as per your need.

What does Care travel insurance cover?

Our travel insurance offers comprehensive coverage, including medical emergencies, trip cancellations, lost baggage, trip delays, etc.

What is covered under the emergency hospitalisation benefit of Care travel insurance?

Care travel insurance covers inpatient and outpatient medical expenses incurred due to unforeseen emergencies during your trip.

Does Care travel insurance cover pre-existing medical conditions?

Yes, our travel insurance covers pre-existing medical conditions, ensuring you're protected in case of an emergency caused by a pre-existing ailment.